2013 First Quarter Results

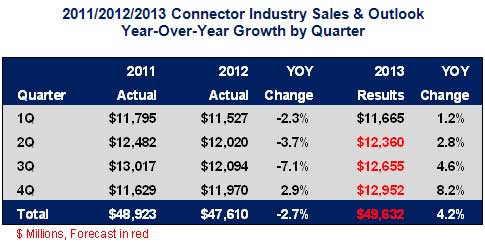

The year started off with first quarter connector industry revenues of $11,655 million, up +1.2% from prior year. This was approximately three and one half points lower than Bishop anticipated in January. Bishop had projected 1Q’13 to grow +4.9% over 1Q’12. After year-over-year growth of +7% in January, February was down -5.2% and March sales declined -4.1% year-over-year, resulting in a worsening of the first quarter performance.

The first quarter performance of the top three companies is as follows:

- Amphenol reported year-over-year sales growth of 10% in 1Q’13 with 4% of the growth being organic. Sales were up 42% year-over-year in mobile devices, double-digit year-over-year increases in commercial aerospace and broadband, and high single-digit increases in automotive and industrial. Quarter-to-quarter, sales were down 5.8%.

- Molex reported a modest year-over-year increase of +1.9% in calendar 1Q’13 which was down -11.9% sequentially from 4Q’12. Year-over-year sales growth was up in the high double-digits for mobile devices and medical/military, and low double-digits for automotive. Consumer sales were down double-digits, and infotech, telecom and industrial were down in the single-digits.

- TE Connectivity reported sales growth of +0.5% in calendar 1Q’13 which was up +4.2% sequentially. Organically, sales were down -4% year-over-year. Sales were up 47% year-over-year in mil/aero/marine due to the acquisition of Deutsch and automotive was up single-digits. Enterprise networks and industrial were down double-digits. Energy, consumer, appliances, data communications and telecom networks were single-digits year-over-year.

The combined results of the top three are sales of $5,198 million, up 2.6% year-over-year and down 1% sequentially.

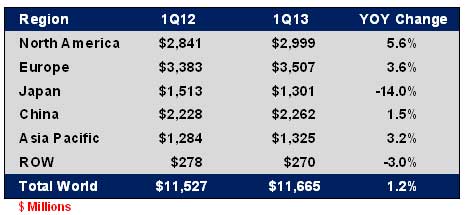

The following table shows the 1Q’13 results by region.

2013 Full-Year Outlook

Amphenol is projecting year-over-year sales growth of +5.1% to +7.4% for 2Q’13 and +6.7% to +8.5% for the full-year 2013. Molex is projecting calendar 2Q’13 to grow +1.3% to +5.9% year- over-year. TE is projecting calendar 2Q’13 sales to change -5.0% to +2.1% year-over-year and full fiscal year sales to change -1.3% to +1.0%.

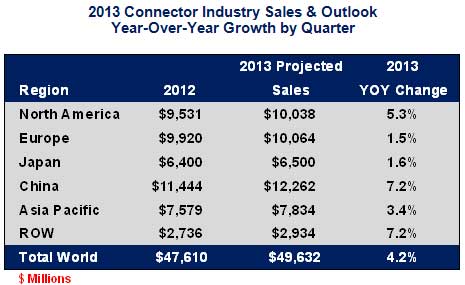

Bishop is forecasting +4.2% growth in sales for 2013 to a market value of $49,632 million.

The following points support this:

- Strong automobile sales in North America and China drive connector consumption directly and in other industries such as industrial.

- Strong stock market performance in the United States makes consumers more confident in their financial situation and increases their inclination to spend which drives economic growth.

- Strong housing market sales in the United States and low inventories of existing homes will prompt new construction and increasing connector consumption in appliance and industrial market sectors.

The threats to the forecast are:

- The continuing political and fiscal instability of Europe will keep down consumer spending and automotive production.

- Persistently high unemployment levels in the United States and Europe dampens consumer confidence and disposable income.

- Slowing of the economic growth in China and Asia Pacific holds down consumer and business consumption of goods.

We are still projecting a weak first half of 2013, followed by improving growth in the second half of the year, as can be seen in the following chart.

The following table shows the anticipated results by region.