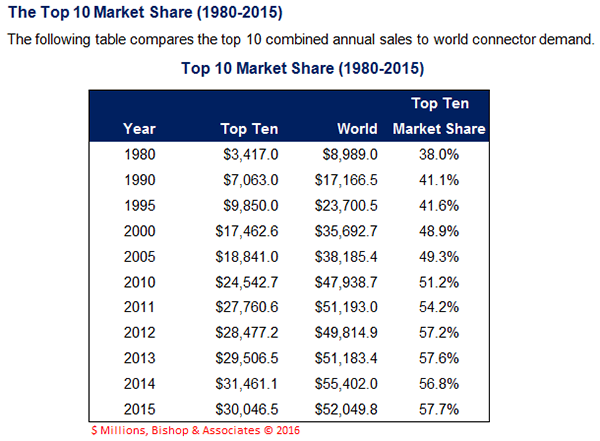

The 10 largest connector companies had combined 2015 sales of $30 billion, or 57.7% of world connector demand.

The following table identifies the top 10 as defined by total world connector sales for 2015.

The above table reveals some interesting trends:

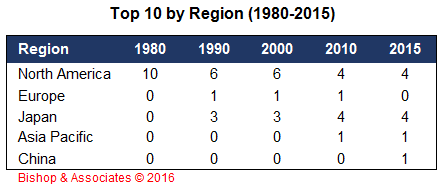

- There are now only four U.S. based companies ranked in the top 10 (TE Connectivity #1, Amphenol #2, Molex #3, and Delphi #4).

- There are four Japanese companies in the top 10 (Yazaki #5, JAE #7, JST #8, and Hirose #10).

- There is one top 10 company from the Asia Pacific region (Foxconn, Taiwan #6).

- For the first time, a Chinese company achieved top 10 ranking. Luxshare, ranked #9, is a publicly traded company headquartered in Guangdong, China. The company achieved 2015 sales of $1.1 billion serving the computer, telecom, consumer, automotive, industrial, and medical markets.

- The top 10, as a group, reported a 1.0% decline in sales in 2015. This compares favorably to an industry wide sales decline of -6.1%. The better performance of the top 10 was aided greatly by acquisitions.

Note, the three largest companies, TE Connectivity, Molex and Amphenol, are very active acquirers.

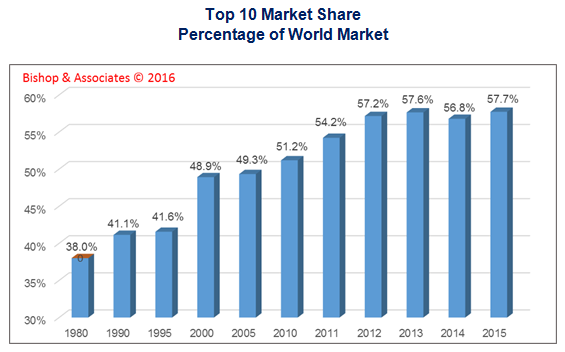

The top 10 accounted for 38% of the world connector demand in 1980 and 57.7% in 2015. The dramatic market share growth is primarily a function of acquisitions.

We have recorded over 300 acquisitions in the connector industry between 1980 and 2015. Many of the acquisitions were made by top 10 companies. Some of the large acquisitions include:

- TE Connectivity purchased Thomas + Betts, Siemens EC, M/A Com, Elcon, Deutsch, and many others.

- Amphenol acquired Teledyne’s connector business, FCI, and many other smaller companies.

- Molex purchased Woodhead, Cardell, FCT, and numerous other smaller companies.

- Delphi acquired Specialty Electronics and FCI’s automotive connector business.

TOP 10 Landscape Changes

Since 1980, there has been a dramatic change in the companies that comprise the top 10. Some companies have moved up in rank, others have moved out of the top 10 and still others have gone out of business or have been absorbed into larger companies.

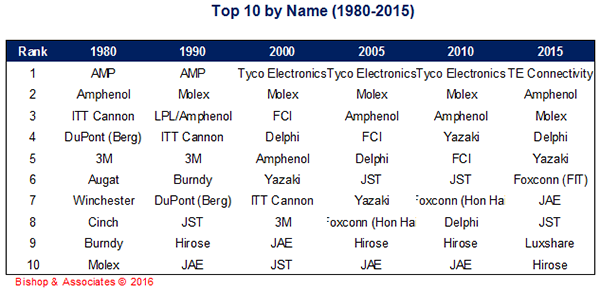

The following table provides a history of the top 10 over a 35-year time frame.

Some highlights include:

- TE Connectivity has remained the largest connector company since 1980. The name changed from AMP to Tyco International to Tyco Electronics and currently to TE Connectivity.

- Molex and Amphenol remained in the top 10 throughout this timeframe. Molex moved from 10th largest in 1980 to the third largest in 2015. Amphenol, the second largest in 1980 fell to fifth in 2000 and regained #2 rank in 2005, where the company is still ranked in 2015.

- Companies that were in the top 10 in 1980 but have not retained a top 10 ranking are ITT Cannon, 3M, Winchester, Augat, Cinch, and Burndy. Dupont (Berg) and Burndy were acquired by Framatone (FCI) and later by Amphenol. Augat was acquired by T&B and later by TE, while Cinch was acquired by Bel and Winchester was acquired by a private equity firm.

- There were no Asian companies in the top 10 in 1980. In 2015, there were six Asian companies represented in the top 10.

The following table shows the number of top 10 companies, by region of the world, over the 35-year period (1980-2015). Top 10 by Region (1980-2015)

Luxshare achieved a top 10 rank in 2015, making it the first and only Chinese company achieving top 10 status. Europe now has no companies in the top 10 because Amphenol, a U.S. based company, purchased FCI.