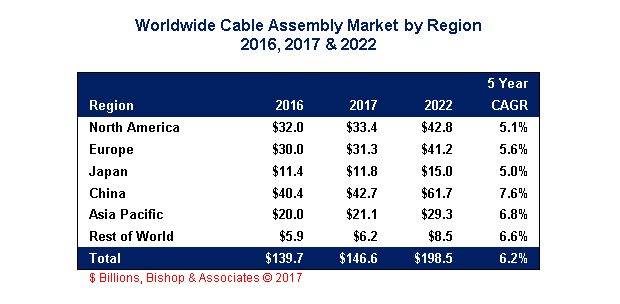

The worldwide market for cable assemblies was $139.7 billion in 2016. The cable assembly market grew 4.2% in 2016. The worldwide growth included North America up 2.8%, Europe up 5.5%, Japan down 6.4%, China was up 12.1%, Asia Pacific was down 3.0% and ROW was up 4.9%.

The worldwide cable assembly market will grow at a compound annual rate of 6.2% from 2017 to 2022, to a market value of $198.5 billion. No worldwide recessions are projected during this timeframe and regional GDP growth was used as the primary basis for the projections of the industry growth.

The Market by Region of the World

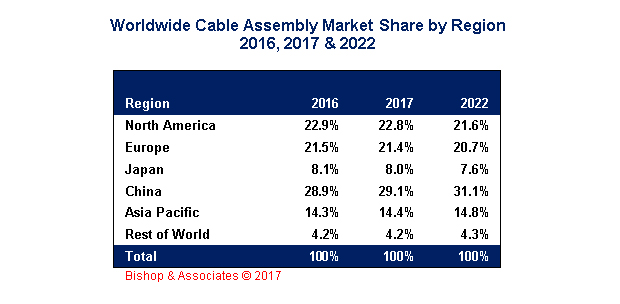

China is the largest cable assembly region in 2016 at 28.9%. North America, Europe and Japan are all expected to lose market share through this forecast period.

Worldwide market share in the cable assembly market is beginning to stabilize. In the past, it seemed that China would take it all, but that trend is slowing down for various reasons. Part of the change is that China already has a significant share of the computer market, which in itself has slowed, leaving little for China to gain (plus China is “off-shoring” cable assemblies to lower labor rate areas). Additionally, some of the cable assembly business will ultimately stay where the final products are being assembled. The automotive industry is a good example of that on-shore inclination, and automotive represents 29.5% of the cable assembly industry in 2016. China will likely retain, however, their new status “world’s manufacturer” and the prosperity (and increasing costs) that come with their success.

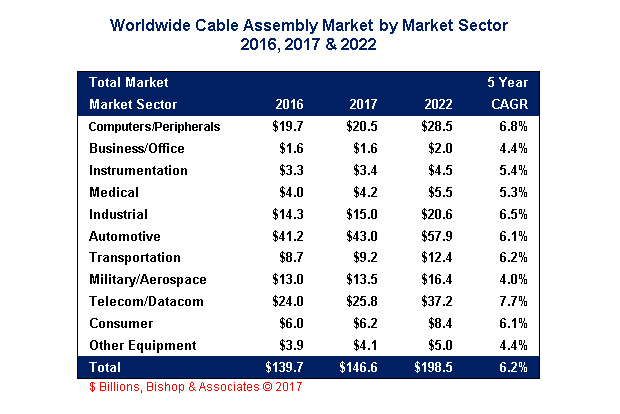

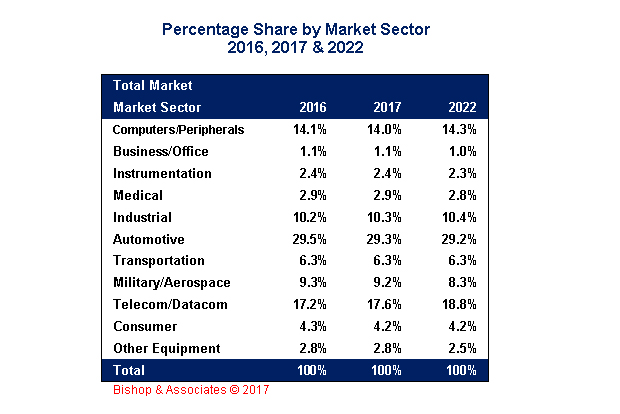

The Market by Market Sector

In 2016, automotive was the largest segment with a market value of $41.2 billion representing 29.5% of the overall market. Telecom/Datacom was the next largest segment with a market value of $24.0 billion, or 17.2% of the market. Computers and peripherals is the third largest market sector with a value of $19.7 billion, or 14.1% of the total market value.

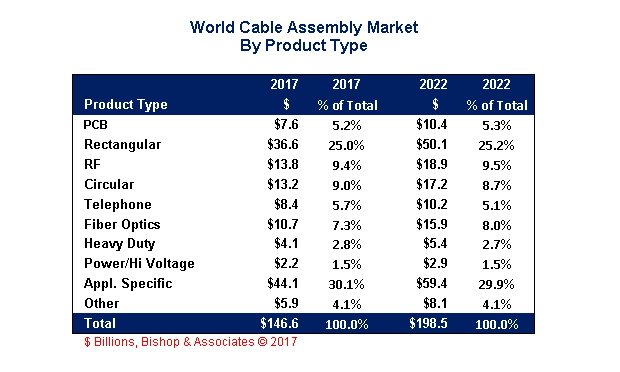

The Market by Product Type

Cable assembly types include: printed circuit board (PCB) assemblies, rectangular I/O assemblies, radio frequency (RF) assemblies, circular assemblies, telephone/RJ45 assemblies, fiber optic (FO) assemblies, heavy duty assemblies, power/high voltage assemblies, application specific assemblies and other assemblies.

By market value, the largest group of cable assemblies is application specific at $44.1 billion in 2017. The largest segment within application specific is automotive assemblies.

The second largest group of cable assemblies is rectangular assemblies with a market value of $36.7 billion in 2017. This group of assemblies is widely used for I/O functionality across all market sectors. The largest market sector within rectangular cable assemblies is automotive.

Application specific and rectangular combined equal 55.1% of the overall cable assembly market by product type.

The following table shows the product types used in the cable assembly industry for 2017 and 2022.

As can be seen in the above table, the product types as a percent of the total is shifting over time. Comparing 2017 to 2022, the larger changes by product type are occurring in:

- Fiber optics assemblies are increasing as they displace telephone assemblies for higher speed interconnect in datacom and high performance computing.

- Application specific is down (in value) as the local markets for automotive grow in China and Asia Pacific (with their lower costs).

- Circular is lower as military/aerospace grows at a slower pace.

- Rectangular is up with growth in computers, automotive and other markets.

For more in-depth information on the cable assembly market, the 2017 World Cable Assembly Market report is available on our web site here.