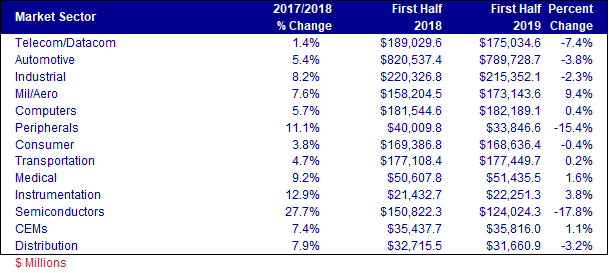

Six of the 13 market sectors Bishop & Associates tracks had year-over-year growth during the first six months of 2019. Mil/aero experienced the highest growth rate at 9.4 percent. Semiconductors declined the most, contracting 17.8 percent, followed by peripherals with a decline of 15.4 percent.

The following table provides the 2017/2018 percent change in revenues, and the first half 2018 versus the first half 2019 sales and percent change in sales by market sector:

Eleven market sectors had a sequential sales increase in 2Q’19, led by instrumentation with a quarter-over-quarter sales increase of 6.4 percent and followed closely by transportation with an increase of 6.3 percent over the same period.

Mil/aero, consumer and instrumentation were the only three markets to have a year-over-year increase in net income for the first half of 2019 versus the prior year.

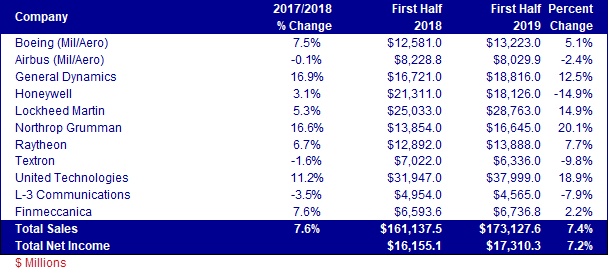

Military/Aerospace Equipment Sector

The military/aerospace equipment sector recorded a sales increase of 7.6 percent in 2018 and had the most growth of all the sectors in the first half of 2019. Sales for the first half 2019 versus the first half 2018 were up 7.4 percent year-over-year. Net income as a percent of sales totaled 10.0 percent for the period, up 7.2 percent year-over-year.

Mil/Aero Equipment Sector - Sales and Net Income

Honeywell’s sales decline is attributed to the spin-offs of their Transportation Systems business and their Homes/ADI Global Distribution business. Northrop Grumman’s second quarter 2019 sales increased $1.3 billion primarily due to the addition of a full quarter of Innovation Systems sales as well as higher sales at Mission Systems and Aerospace Systems. United Technologies’ second quarter sales of $19.6 billion were up 18 percent over the prior year, including 6 points of organic sales growth and 13 points of acquisition benefit offset by 1 point of foreign exchange headwind.

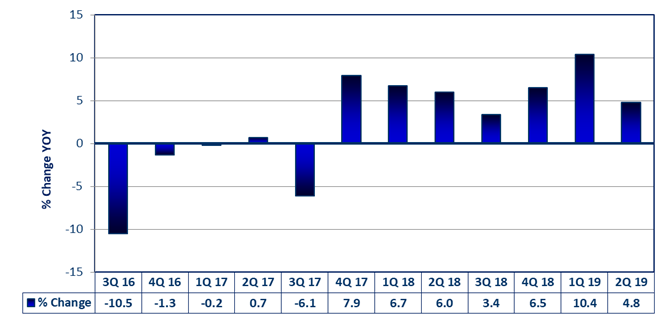

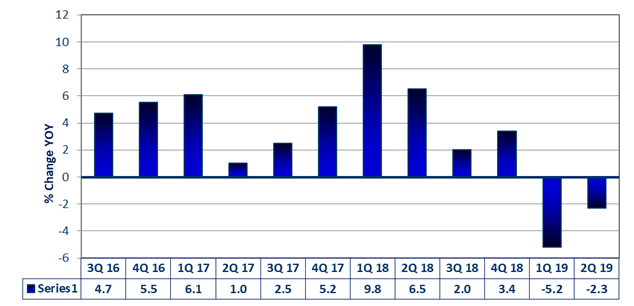

Military/Aerospace: YoY Percentage Change in Sales by Quarter

$ Millions

Quarter-to-quarter (2Q19 versus 1Q19) sales increased 4.4 percent. Year-over-year, sales increased 4.8 percent in the second quarter.

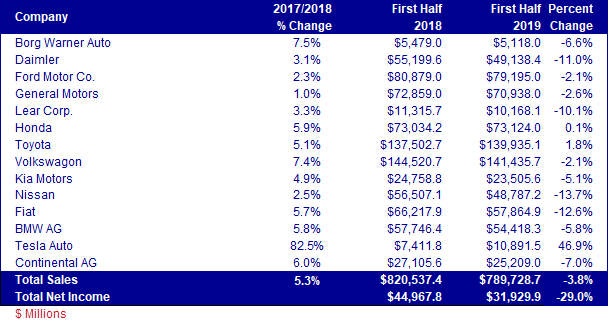

Automotive Equipment Sector

The automotive equipment sector is the largest group of companies by sales volume and recorded a sales increase of 5.3 percent in 2018. Sales for the first half 2019 versus the first half 2018 were down 3.8 percent year-over-year. Net income as a percent of sales totaled 4.0 percent for the period, down 29.0 percent year-over-year.

Automotive Equipment Sector – Sales and Net Income

Tesla’s sales increase resulted from increased production of the Model 3. Overall demand for vehicles declined worldwide, especially in China.

Quarter-to-quarter sales (2Q’19 versus 1Q’19) increased 2 percent. Year-over-year, sales decreased 2.3 percent in the second quarter.

Looking at all of the sectors for the full year 2019, it looks like five market sectors will have declining sales year-over-year and three market sectors will have increasing sales from the prior year. The others are too close to call. Semiconductors, a leading indicator for the connector industry, will likely be down around 15 to 18 percent from 2018.

Bishop & Associates tracks sales and profits of 13 market sectors and more than 120 companies. The objectives are to determine how selected electronic markets have performed, identify sales and profit trends for forecasting purposes, and monitor company performance within market sectors.