Bishop & Associates tracks sales and profits of 13 market sectors and more than 120 companies. The objectives are to determine how selected electronic markets have performed, identify sales and profit trends for forecasting purposes, and monitor company performance within market sectors.

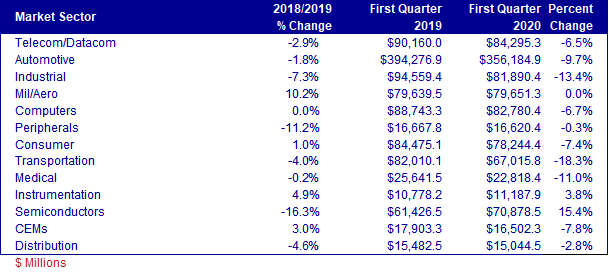

The following tables provide the 2018/2019 percent change in revenues, and the first quarter 2020 versus the first quarter 2020 sales and percent change in sales by market sector.

Ten of the 13 market sectors Bishop tracks had year-over-year sales declines during the first quarter of 2020. This quarter reflects the impact that the coronavirus lockdowns had on these industries throughout the first three months of the year. Transportation experienced the steepest decline in sales, contracting 18.3 percent. Industrial fell 13.4 percent, followed by Medical, down 11.0 percent, on year-over-year basis in the first quarter of 2020.

Instrumentation and Semiconductor were the only two sectors to see sales grow in 1Q20, up 3.8 percent and 15.4 percent, respectively.

The aggregate decline for all reported industries was 7.4 percent.

The following looks more closely at the market sectors that did not contract – semiconductor, instrumentation and Mil/Aero.

Semiconductor Equipment Sector

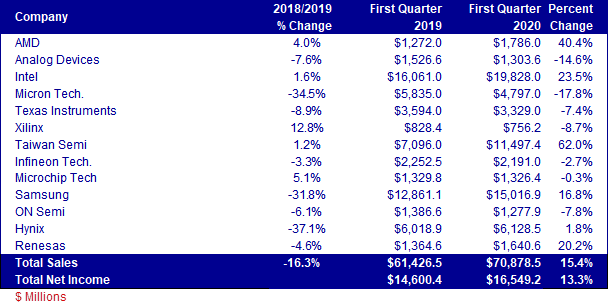

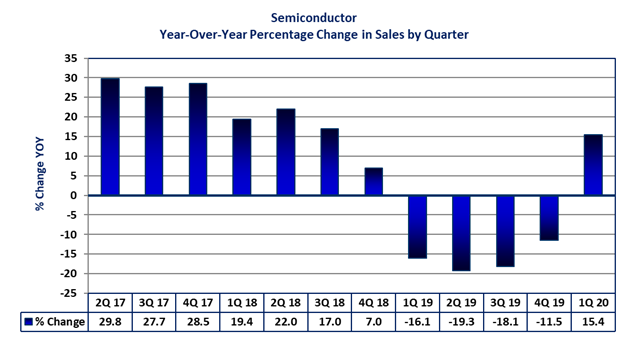

The semiconductor equipment sector recorded a sales decrease of 16.3 percent 2019. Sales for the first three months of 2020 versus the first three months of 2019 were up 15.4 percent year-over-year. Net income as a percent of sales totaled 23.3 percent for the period, up 13.3 percent year-over-year.

Semiconductor Equipment Sector - Sales and Net Income

AMD’s revenue increase was driven by higher sales in the computing and graphics segment. Taiwan Semiconductor’s revenue grew due to the increase in HPC-related demand and the continued ramp up of 5G smartphones.

Quarter-to-quarter (1Q20 versus 4Q19) sales increased 1.2 percent. Year-over-year sales increased 15.4 percent in the first quarter.

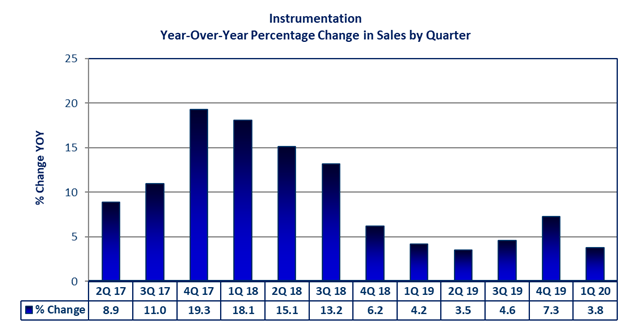

Instrumentation Equipment Sector

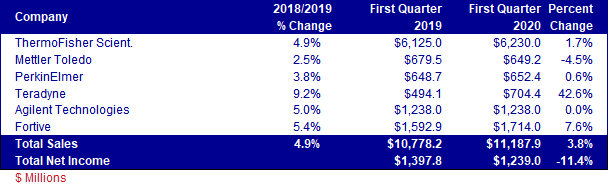

The instrumentation equipment sector recorded a sales increase of 4.9 percent in 2019. Sales for the first three months 2020 versus the first three months 2019 were up 3.8 percent year-over-year. Net income as a percent of sales totaled 11.1 percent for the period, down 11.4 percent year-over-year.

Instrumentation Equipment Sector - Sales and Net Income

Teradyne revenues increased significantly due to demand for test equipment serving the semiconductor industry.

Quarter-to-quarter (Q1 2020 versus Q4 2019) sales decreased 10.4 percent. Year-over-year sales increased 3.8 percent in the first quarter.

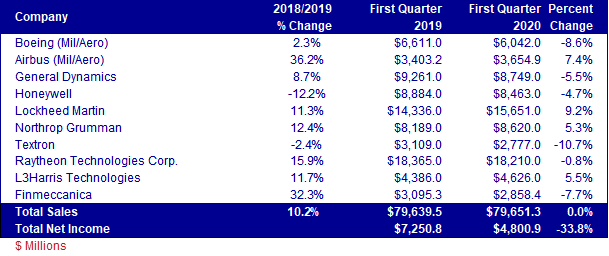

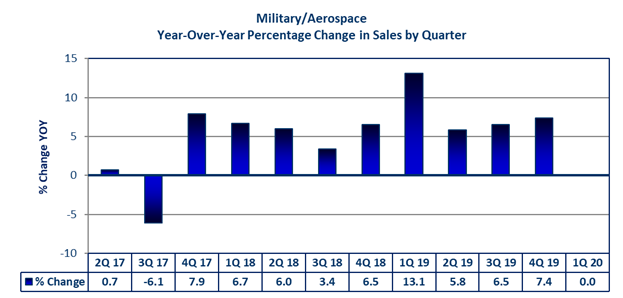

Military/Aerospace Equipment Sector

The military/aerospace equipment sector recorded a sales increase of 10.2 percent in 2019. Sales for the first three months of 2020 versus the first three months of 2019 were flat year-over-year. Net income as a percent of sales totaled 6.0 percent for the period, down 33.8 percent year-over-year.

Mil/Aero Equipment Sector - Sales and Net Income

Quarter-to-quarter (1Q20 versus 4Q19) sales decreased 15.3 percent. Year-over-year, sales were flat in the first quarter.

In summary, the impact of the COVID19 pandemic was just starting to impact the worldwide economy in February/March of 2020. We anticipate that the business results in the thirteen market sectors and individual companies will be starkly lower in the second quarter, for which these firms are just beginning to report their financial results.

Statements of fact and opinions expressed in posts by contributors are the responsibility of the authors alone and do not imply an opinion of the officers or the representatives of TTI, Inc. or the TTI Family of Companies.