Worldwide Semiconductors Sales increased 0.5% y/y to $28.0 billion in August 2016; Largest Monthly Sales Increase in three years

- August sales up 3.5% compared to July, increase year-to-year for first time in more than a year

- Worldwide sales of semiconductors reached $28.0 billion for the month of August 2016, an increase of 3.5% compared to the previous month’s total of $27.1 billion and an uptick of 0.5% over the August 2015 total of $27.9 billion.

- August marked the market’s largest month-to-month growth since May 2013 and its first year-to-year growth since June 2015.

The Semiconductor Industry Association (SIA) announced worldwide sales of semiconductors reached $28.0 billion for the month of August 2016, an increase of 3.5% compared to the previous month’s total of $27.1 billion and an uptick of 0.5% over the August 2015 total of $27.9 billion. August marked the market’s largest month-to-month growth since May 2013 and its first year-to-year growth since June 2015.

“Following months of sluggish global semiconductor sales, the global market recently has shown signs of a rebound, punctuated by solid growth in August,” said John Neuffer, president and CEO, Semiconductor Industry Association. “The Americas market was particularly encouraging, topping 6% month-to-month growth for the first time in nearly three years to lead all regional markets. China also stood out, posting by far the strongest year-to-year growth of all regions in August. All told, global sales are still behind last year’s pace, but appear to be on the right track as 2017 draws closer.”

Source: www.semiconductors.org

Custer Comments:

- Global semiconductor shipments has risen steadily from their April 2016 low (Chart 1) and their 3/12 growth finally moved back into positive territory (3/12>1) following an extended contraction beginning in July 2015 (Chart 2).

- Custer Consulting Group’s semiconductor leading indicator continues to point to a modest expansion ahead (Chart 3).

- The most noticeable growth has been in Asia-Pacific and North America – on both a monthly (Chart 4) and 3-month average (Chart 5) basis.

- North American semiconductor shipments reached their recent low in February and are now rebounding (Chart 6).

- Chart 7 compares the U.S. dollar denominated, 3-month average semiconductor shipments to the key regions for August 2016 vs. August 2015.

September PMI Leading Indicators

IHS Markit (formerly Markit Economics) has now released most of its September PMI leading indicators. Conditions vary by country but in general they have improved compared to August.

- Global PMI rose from 50.8 in August to 51.0 in September (Chart 8). Values greater than 50 indicate a manufacturing expansion.

- Chart 9 compares the August vs. September PMIs for key countries/regions. All improved except S. Korea which slipped further into contraction.

- U.S. findings varied by market research organization as ISM (Institute of Supply Management) reported September PMI growth while Markit reported a decline (Chart 10).

- The Eurozone September PMI rebounded from an August decline (Chart 11) as a group of key European countries all had higher PMIs in September vs. August (Chart 12).

- Asian PMIs for all key countries except S. Korea improved in September vs. August (Chart 13)

Source: www.markiteconomics.com

www.instituteforsupplymanagement.org/

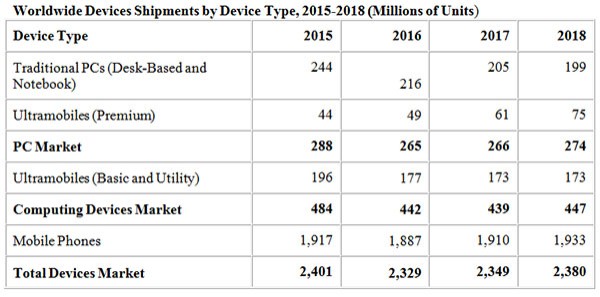

Worldwide Device (PCs, tablets, ultramobiles and mobile phones) Shipments expected to decline 3% to 2.329 billion units in 2016 (Charts 14-16)

Gartner Forecasts Worldwide Device Shipments to Decline for Second Year in a Row Mobile Phone Shipments Will Fall 1.6% in 2016, but Will Return to Growth in 2017 Gartner, Inc. said worldwide combined shipments for devices (PCs, tablets, ultramobiles and mobile phones) are expected to decline 3% in 2016. This will mark the second consecutive year of decline. The global devices market fell by 0.75% in 2015.

“The global devices market is not on pace to return to single-digit growth soon,” said Ranjit Atwal, research director at Gartner. Growth is on pace to remain flat during the next five years. All segments are expected to decline in 2016, except for premium ultramobiles and utility mobile phones (entry level phones), which are expected to show single-digit growth this year.

“We expect premium ultramobiles will start benefiting from the collective performance and integration of the latest Intel CPU platform and Windows 10,” added Atwal.

Note: The Ultramobile (Premium) category includes devices such as Microsoft's Windows 10 Intel x86 products and Apple's MacBook Air.

The Ultramobile (Basic and Utility Tablets) category includes devices such as, iPad, iPad mini, Samsung Galaxy Tab S2, Amazon Fire HD, Lenovo Yoga Tab 3, Acer Iconia One.

PC Market to Bottom Out in 2016 & PC Prices in the UK to Increase Less Than 10% in 2017

The PC market is expected to exhibit an 8% decline in 2016, as the installed base bottoms out and replacement cycle extensions halt. “The effect of currency depreciation on the market is diminishing,” added Atwal. “The second quarter of 2016 was the first since the second quarter of 2015 least impacted by currency depreciation.” Regions such as Western Europe, where the Euro depreciated significantly in 2015 and PC prices increased, finally showed flat market growth (-0.9%) in the second quarter of 2016. This follows four consecutive quarters of decline.

If this situation prevails it means that PC sales will bottom out in 2016. However, the PC market in Western Europe remains difficult following the Brexit vote. “Device vendors are mitigating the currency depreciation of the pound in two ways — first, they are taking advantage of the likelihood of a single-digit decline in PC component costs in 2016,” said Atwal. “Second, they will “de-feature” their PCs to keep prices down. With these changes, Gartner expects PC prices in the UK to increase by less than 10% in 2017.”

For the PC market to stay on pace for flat growth in 2017, business spending needs to flourish. “The inventory of Windows 8 PCs should have been cleared, and large businesses in mature markets are now looking to move to Windows 10 through 2018,” added Atwal. "In addition, more affordable hardware and increasingly available virtual reality content (such as games, stories and other entertainment) will enable consumer PC buyers to upgrade in order to experience immersive offerings.

Smartphone Growth to Continue Slowing Down in 2016

Total mobile phone shipments are on pace to decline 1.6% in 2016. The smartphone segment continues to grow, albeit more slowly than in previous years, and is expected to reach 1.5 billion units in 2016. “This is no surprise; the smartphone market is maturing, and reaching global saturation with phones that are increasingly capable and remain good enough for longer,” said Roberta Cozza, research director at Gartner.

In 2016, the Android market will continue to be bolstered by Chinese vendors offering more affordable premium devices. Despite the availability of the iPhone 7, Gartner expects a weaker year-over-year volume performance from Apple in 2016, as volumes stabilize after a very strong 2015. As a result, Gartner expects total smartphone market to only increase 4.5% with premium smartphones declining 1.1% in 2016.

“We expect the market for premium smartphones to return to 3.5 per cent growth in 2017, as stronger replacement cycles kick in and in anticipation of a new iPhone next year, which is expected to offer a new design and new features that are attractive enough to convince more replacement buyers,” said Cozza.

Source: www.gartner.com

Worldwide cloud IT infrastructure revenues grew 14.5% y/y to US$7.7 billion in 2Q’16

According to IDC vendor revenues from sales of infrastructure products (server, storage, and Ethernet switch) for cloud IT, including public and private cloud, grew by 14.5% on year to US$7.7 billion in the second quarter of 2016, ahead of renewed hyperscale growth expected in the second half of 2016.

The overall share of cloud IT infrastructure sales climbed to 34.9% in the second quarter of 2016, up from 30.6% a year ago. Revenues from infrastructure sales to private cloud grew by 14% to US$3.1 billion and to public cloud by 14.9% to US$4.6 billion.

In comparison, revenues in the traditional (non-cloud) IT infrastructure segment decreased 6.1% on year in the second quarter. Private cloud infrastructure growth was led by Ethernet switch at 49.4% on-year growth, followed by storage at 19.7%, and server at 8.9%. Public cloud growth was also led by Ethernet switch at 61.8% on-year growth, followed by server at 25.1% while storage revenues for public cloud declined 6.2% on year. In traditional IT deployments, server declined the most (7.5% on year) with Ethernet switch and storage declining 2.2% and 2%, respectively.

“As expected, the hyperscale slow down continued in the second quarter of 2016,” said Kuba Stolarski, research director for Computing Platforms at IDC. “However, deployments to mid-tier and small cloud service providers showed strong growth, along with private cloud buildouts. In general, the second quarter did not have as difficult a compare to the prior year as the first quarter did, and this helped improve growth results across the board compared to last quarter. In the second half of 2016, IDC expects to see strengthening in public cloud growth as key hyperscalers bring new datacenters online around the globe, continued strength in private cloud deployments, and declines in traditional, non-cloud deployments.”

From a regional perspective, vendor revenues from cloud IT infrastructure sales grew fastest in Latin America at 44% on year in the second quarter of 2016, followed by Western Europe at 41.2%, Japan at 35.4%, Canada at 21.8%, Central and Eastern Europe at 21%, Middle East and Africa at 16.8%, Asia Pacific (excluding Japan) at 15.8%, and the U.S. at 6.7%.

Source: www.idc.com

International Monetary Fund says U.S. Economy Losing Momentum

The IMF said the American economy will expand by only 1.6% this year, down from 2.6% in 2015. The latest forecast is 0.6%age points lower than what the fund predicted just three months ago.

The downgrade is mostly down to sluggish second quarter U.S. growth, the fund said in its latest World Economic Outlook.

The world's largest economy grew by just 1.4% between April and June compared to the same period last year, according to U.S. government data. The performance was well below economist expectations.

“The U.S. economy has lost momentum over the past few quarters, and the expectation of a pickup in the second quarter of 2016 has not been realized,” the IMF said.

Growth in personal consumption, the main engine of the American economy, is strong thanks to low unemployment and higher wages.

But businesses are a problem – investment spending has now dropped for three consecutive quarters. The IMF said that the upcoming presidential election was also adding to uncertainty.

“Institutional arrangements long in place are now potentially up for renegotiation – arrangements that have shaped how businesses organize their production and hiring, sourcing of raw materials and financing, and distribution channels across borders,” the fund said.

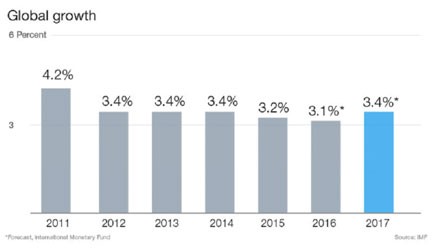

The IMF said that global growth will also slow in 2016, prompting interest rates to stay lower for longer. It expects growth of 3.1% in 2016, down from 3.2% last year. The fund said growth will pick up slightly in 2017.

The fund blamed slower U.S. growth and the U.K.'s decision to leave the European Union for its grim outlook.

One bright spot will be emerging markets and developing economies, where the IMF expects growth to strengthen to 4.2% this year after five consecutive years of decline.

But even there gains will be uneven. India will charge ahead, but big economies in sub-Saharan Africa, such as Nigeria, will experience sharp slowdowns.

Source: www.imf.org/

DRAM Contract Prices Expected to rise nearly 30% in 4Q’16 due to Stronger-than-expected Notebook Demand

DRAMeXchange expects DRAM contract prices to rise nearly 30% in the fourth quarter of 2016, thanks to stronger-than-expected notebook demand.

“The price hike in the spot market for DRAM chips has been more significant,” said Avril Wu, research director of DRAMeXchange. “In September, the average spot prices of 4Gb DDR3 and DDR4 chips rose 19% and15% respectively compared with the prior month to US$2.1 and 2.0, indicating that the market demand continues to outpace supply.”

Contract prices for PC DRAM averaged US$14.50 in September, up 7.4% sequentially. DRAMeXchange credited the price rally to chipmakers' product-mix adjustments that led to tighter supply of PC DRAM and higher-than-expected demand for notebooks. The average contract prices for the fourth quarter is set to reach its highest point in two years, the price tracker indicated.

As a result of suppliers' adjustments to their product mixed, mobile DRAM as a proportion of total DRAM output worldwide expanded to over 40% in the third quarter of 2016, while PC DRAM fell below 20%, DRAMeXchange said.

On the demand side, notebook and smartphone vendors have started to build inventory. Meanwhile, the number of new notebooks carrying 8GB DRAM modules (especially enterprise models) has increased sharply ahead of the peak sales season at the end of the year.

“Since the third quarter, PC-OEMs have become more willing to accept premium prices for PC DRAM in order to secure the volumes they need,” Wu continued. “In the fourth quarter, the PC DRAM market will witness an even larger price hike. The undersupply problem will worsen as well due to DRAM makers underestimating the increase in demand.”

Furthermore, some suppliers have not raised the yield rates for their 20nm and 21nm processes to expected levels. This means that the industry's overall PC DRAM output is unlikely to even satisfy the originally estimated demand. Under the circumstances, PC-OEMs are “frantically” building up their DRAM inventories, DRAMeXchange noted.

“The intense competition for PC DRAM supply is causing price hikes for other memory products as well,” Wu said. “The global average contract price of server DRAM has risen by about 10% since the start of the third quarter.”

At the same time, the NAND flash market is experiencing shortages, according to DRAMeXchange. In the fourth quarter, the average selling price of eMCP devices will increase by 10-15% compared to the prior quarter.

Source: www.dramexchange.com

SSD shipments increased 41.2% y/y to 33.705 million units in 2Q’16 (Charts 18-20)

Shipments of SSDs in 2Q’16 were 33.705 million units, which is nearly 10 million units higher than in the same period a year ago and up 9.5% from the previous quarter, according to TrendFocus.

Source: www.trendfocus.com