It was a slow news week between Christmas and New Year’s Day but here are a few items we found interesting:

Is World's Factory 'hollowing out' as Manufacturers pack up and leave China?

Concerns raised as increasing tax and labor costs prompt Chinese producers to move business offshore.

Fears are being raised of a “hollowing out” in China, formerly thought of as the world's factory, after a mainland tycoon explained his rationale to set up factories in the United States and Foxconn, the world's largest contract electronics manufacturer, also suggested it might move some operations across the Pacific.

“Hollowing out” refers to the deterioration of a country's manufacturing sector when producers move to low-cost facilities overseas. Some economists believe the world's leading developed economies are being hollowed out, threatening full employment in those locales.

Since China's opening up in the 1980s and ’90s, and particularly so since it joined the World Trade Organization in 2001, China has been a key destination for manufacturing to relocate from advanced economies, in the process making it the world's second-largest economy.

Academics and Chinese workers have sensed a sea change in this situation after U.S. president-elect Donald Trump began urging, and even bullying, American businesses to bring jobs back to the U.S. at a time when China's tax and regulatory regimes are becoming hostile to private manufacturers.

The central government has also encouraged many labor-intensive businesses to move elsewhere as it tries to steer the economy toward higher value-added services and high technology.

Are China's taxes killing its competitiveness?

In its haste to effect such changes, Beijing barely bothered to aid firms such as footwear maker Stella International, which decided a year ago to close its 13-year-old factory in the southern industrial hub of Dongguan, sacking thousands of workers.

Last week, Cao Dewang, the founder of Fuyao Glass, a leading global supplier of automotive glass, said that the U.S. offers better conditions for his North American plant than China does for those at home. His remarks triggered heated debate about Beijing policies, including a corporate tax system described by some as “death tax”. Taiwan-owned Foxconn Technology Group, which employs about a million workers across China to makes iPhones and other leading electronics under contract, earlier confirmed it was looking to set up factories in the U.S.

“Don't let Foxconn run away” ran a headline that went viral on Chinese social media. The entreaty was in stark contrast to a few years earlier, when Chinese media were describing Foxconn as a sweatshop that drove its employees to suicide.

Lu Zhengwei, chief economist at Industrial Bank, said China's own hollowing out probably started in 2012 when the country's services sector overtook manufacturing for the first time as the biggest contributor to nominal gross domestic product. This was praised by Beijing as a milestone towards industrial restructuring.

“The process began to get serious a long time ago. When we spoke highly of the increasing role of the service industry in our economic structure, it had already kicked in. That was 2012,” Lu said, adding that China's high taxes and high land costs are now turning business away.

When there is a serious lack of domestic demand, there is no return on investment because people don't buy products

Economist Xu Chenggang

Meanwhile, the exodus of manufacturing from China continues. Outbound investment surged more than 50 per cent in the first 11 months of 2016 from a year earlier, with manufacturers involved in more than a third of China's overseas mergers during that period. At the same time, China's private sector investment at home rose just 3.1 percent.

Factories funded by Hong Kong and Taiwanese money, which helped China's boom in past decades, were among the first to retreat. Eclat Textile, Taiwan's largest apparel company, said earlier this month it would pull out of China completely due to deteriorating business conditions and surging wage costs.

Only a few years ago, Changping district in Dongguan was home to hundreds of low-end electronics factories that hummed day and night to meet delivery deadlines, but today many factory compounds stand idle and the streets are quiet.

Why China should follow Trump's example and cut taxes

Xu Chenggang, a Hong Kong-based China economist, argued that poor domestic demand caused by low household incomes was the fundamental reason Chinese manufacturers are looking for investment opportunities abroad.

“When there is a serious lack of domestic demand, there is no return on investment because people don't buy products,” Xu said.

Today's China resembles 1980s industrial Japan in many ways, according to Arthur Kroeber, head of research at Gavekal Dragonomics. China is dealing with an ageing workforce just as Japan did in the ’80s, and both countries used their powerful exports to rise in the global economic rankings to threaten U.S. political and economic dominance.

The difference is that Japan dealt with its hollowing out by moving quickly up the supply chain while keeping its core technology at home. China, however, still lags behind in innovation, according to Lu from Industrial Bank.

China's machinery manufacturing, the most advanced and investment-intensive part of its manufacturing economy, saw losses expand by two per cent in 2015 in a downward spiral, which has reflected in overcapacity and a short supply of high-end machines, according to a report from the Research Institute of Machinery Industry Economic and Management in Beijing.

Without doubt, China remains a powerful player in global manufacturing that enjoys a good infrastructure, an army of skilled and disciplined workers and a large domestic market.

“It's premature to worry about manufacturing in China being hollowed out just because a number of China-based manufacturers are shifting some operations to the U.S.," said Leslie Young, a professor of economics at the Cheung Kong Graduate School of Business in Beijing.

“The most important measures to boost manufacturing in China are political, to assure Chinese manufacturers of a predictable business environment, transparent regulations, a level playing field and secure property rights.”

Source: www.scmp.com/

Apple Considering Manufacturing iPhones in Bengaluru from April 2017

The Cupertino company might ditch long-term partner Foxconn for Indian production.

Apple finally looks set to manufacture iPhones in India from April next year. A report in the Times of India suggests that the company has chosen Bengaluru as the place of choice for the production.

The report said the factory will be set up in Peenya industrial area of the city. Also, in a surprise move, Apple would partner with Taiwanese Wistron to produce smartphones instead of its long-standing manufacturer Foxconn. Latter already has a sizeable presence in the country by producing phones for the companies such as Xiaomi and OnePlus.

Apple has been pushing to produce the phones in India in the recent times. It has also sought the support of various ministries to get relaxation on labelling and taxing norms. The government is already considering the request by assigning a special group for the matter.

CEO Tim Cook had visited India earlier this year and had inaugurated two development centers in Hyderabad and Bengaluru. He also met Prime Minister Narendra Modi to discuss the possibility of opening the stores in the country. Modi invited him to make phones in India.

The company had a great year in India with almost 50% growth in sales, selling over 2.5 million phones. The revenue figures were very impressive as well as Apple took the second spot behind the juggernaut Samsung. In just three days after the demonetisation almost 1 lakh iPhones were sold.

Source: www.huffingtonpost.com/

Smartphones' Flexible AMOLED Panel Shipments to triple y/y to 150 million units in 2017

An estimated 150 million flexible AMOLED panels for use in smartphones will be shipped globally in 2017, triple the shipments in 2016, according to industry sources.

Apple will launch a 5.8-inch iPhone equipped with flexible AMOLED display and 4.7- and 5.5-inch iPhone models with LTPS TFT-LCD panels in 2017, resulting in large demand for flexible AMOLED panels, the sources said. In addition, China-based vendors, mainly Huawei Technologies, Oppo and Vivo, will launch smartphones with flexible AMOLED panels in 2017, the sources noted.

Samsung Display has dominated the global supply of smartphone-use AMOLED panels, while China-based EverDisplay Optronics (Shanghai) and Visionox can supply small volumes, the sources indicated. As global demand for flexible AMOLED panels will exceed global supply in 2017, it’s possible only Apple and Samsung Electronics will be able to secure sufficient supply to meet their demand, the sources said.

In comparison with flexible AMOLED panels, LTPS panels used in smartphones have the advantage of allowing narrow-bezel screens, the sources noted. In 2017, smartphones with LTPS panels will have narrow-bezel screens with a ratio of screen to front exceeding 90%, the sources indicated.

Source: www.digitimes.com

China Market: Component Order Visibility weak from some Smartphone Vendors for 1Q’17

The visibility of component orders from some China-based smartphone vendors, notably Huawei, Xiaomi Technology and LeEco, for the first quarter of 2017 has become weak recently, according to sources from the handset supply chains in Taiwan and China.

Smartphone inventory levels in the China market have scaled up recently as sales growth of mid-range to high-end smartphones have been slowing down, forcing some vendors to pull in component orders slowly, said the sources.

Although Huawei claimed recently that shipments of its Huawei P9 devices have reached over 10 million units, the company's first model to reach that milestone, the vendor appears to have cut back its component orders for the first quarter of 2017, indicated the sources.

Huawei has seen its shipment volume and market share increase significantly in 2016, and therefore it will be difficult for the vendor to continue to enjoy high growth in the coming year due to keen market competition, commented the sources.

Xiaomi has been cautious over inventory controls recently as sales of all its lineups have been lower expected in the third and fourth quarters of 2016, and market sources expect the slack sales to continue in the first quarter of 2017.

LeEco has turned more conservative about the expansion of its smartphone business, due to its recent financial constraints. LeEco has reached new payment terms with component suppliers and will pay its accounts payables in installments, noted the sources, adding that component suppliers will also be cautious about shipping parts to LeEco.

Source: www.digitimes.com

China Smartphone Vendors cut Orders Shipping in 1Q’17

China-based smartphone vendors, including Huawei Technologies, Xiaomi Technology and LeEco, have decreased orders with shipments scheduled for the first quarter of 2017, according to China-based supply chain makers.

Source: www.digitimes.com

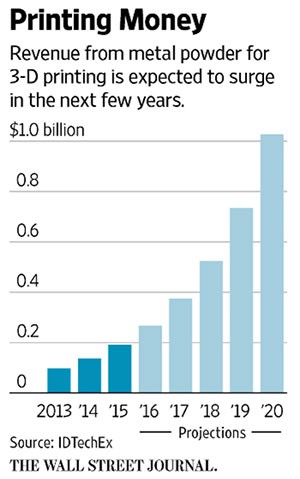

Global 3-D Printing Powder Market will increase from about $250 million in 2016 to over $5 billion in 2025

Powders made of aluminum, nickel and other industrial metals are used to make rocket-ship parts and aerospace components

The rise of 3-D printing is bringing hundreds of millions of dollars of new investments to a niche market that dates back thousands of years: metal in powder form.

Three-dimensional printers use metal powders to create a variety of products, from medical implants made out of titanium to rocket-ship parts made of a nickel alloy.

Demand for powders made of aluminum, cobalt and other industrial metals is poised to take off over the next decade as 3-D printing technology becomes more widely used, especially in industries that use tailored components and parts. IDTechEx, a research firm, forecasts the global 3-D printing powder market to exceed $5 billion in 2025, up from about $250 million in 2016.

Only a small number of producers globally supply metal powder that is suitable for use in 3-D printing. That has prompted a number of companies to focus on the powder business this year to tap this growing market.

Traditional producers are looking to develop smaller, higher margin businesses as China has taken over as the largest supplier of metals, said Julian Kettle, vice chairman of metals and mining at research firm Wood Mackenzie.

“[These companies] are looking to add value rather than occupy the pure commodity space,” Kettle said. “It’s time to get out because [China] will kill it.”

To create a computer design, printers spread powder onto a surface and use a laser to fuse the metal together layer by layer. Also known as additive manufacturing, the process requires specially made powder for the printing of metal parts.

Demand for tailored parts in aerospace, automotive and medical industries is driving the interest in 3-D metal printing. Aerospace, especially, looks to be a promising field of growth as traditional manufacturing demand has slowed over the past few years.

Slowing demand led industrial metal prices to multiyear lows in early 2016, but prices have seen a resurgence as optimism over future growth and manufacturing has picked up. Prices for metals such as nickel and aluminum are up 17% and 13% for the year, respectively.

Earlier this year, Alcoa Corp. opened a metal powder plant in Pittsburgh as part of a $60 million investment in 3-D printing and materials, designed to develop titanium, aluminum and nickel powders. Arconic Inc. will operate the new facility.

“I think we’re at a point here where the capabilities of 3-D printing, particularly in metals, [are] so limitless,” said Klaus Kleinfeld, chairman and chief executive of Arconic, which spun off Alcoa’s traditional commodity business in November.

Kleinfeld said aerospace will account for about 40% of Arconic’s revenue. Companies such as Boeing Co., Airbus Group SE and Rolls-Royce Holdings PLC have used 3-D metal printing to create parts and prototypes on a small scale.

General Electric Co. also has been moving into 3-D metal printing and materials, bidding about $700 million to acquire Sweden’s Arcam AB and paying $599 million for Germany’s Concept Laser this year. In a September investor call to discuss an offer for Arcam and Germany’s SLM Solutions, Chief Financial Officer Jeff Bornstein said he expected 40% of revenue in the company’s 3-D printing business to come from services including materials and powders, which will be “very lucrative.”

3-D printing was first popularized as a new way to produce plastic parts. But as the excitement around plastic 3-D printing dwindled, interest in metal printing increased. Sales of 3-D metal-printing systems reached more than 800 units last year, eight times more than sales a decade ago, according to industry analysts Wohlers Associates.

For all its promise, widespread adoption of 3-D printing remains a challenge due partly to high costs and lack of comprehensive testing. The technology for 3-D printing, which was created in the 1980s, is still in its infancy. Fewer than 100 companies are actively pursuing 3-D printing with metal powder, according to the Metal Powder Industries Federation.

Metal producers eager to get into 3-D printing also face a number of hurdles. About 53% of global metals organizations have invested or plan to invest in research and development in additive manufacturing, and 40% are considering an investment, according to an August report from consulting firm KPMG. But after years of low metal prices, a lack of capital could slow investments for the next few years, the report said.

“Most metals companies are trying to figure out how to make investments in this space as they go forward, but they’re looking for the right timeline,” said Eric Logan, lead metals strategist at KPMG in the U.S.

Iluka Resources Ltd. and BHP Billiton Ltd., the world’s largest mining company, have both invested in metal powder producer Metalysis. While Metalysis began producing metal powder eight years ago, Chief Executive Dion Vaughan said 3-D metal printing has driven most of its business since interest started picking up two years ago.

Vaughan expects 3-D printing powder to account for more than half of the company’s overall activity in the next year. “It’s probably the most important thing that we do,” he said.

Source: www.wsj.com

www.idtechex.com/