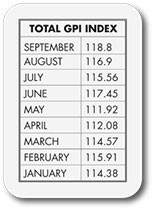

A monthly benchmark that gauges purchasing professionals’ views on procurement activity in the electronic components marketplace. A reading below 100 indicates pessimism; a reading above 100 indicates optimism.

GPI up nearly 2% in September

Business confidence continues to rise among buyers of electronic components as Global Purchasing Index hits 9-month high.

Buyers of electronic components maintained their optimistic outlook in September, as Global Purchasing’s monthly business confidence index rose for the second straight month and hit its highest level since January.

The Global Purchasing Index rose 1.7% to 118.8 in September, following a 2.3% rebound in August. September represents the index’s highest reading since its launch in January and a 1% increase compared to June’s high of 117.45. The reading indicates growing optimism among North American buyers of electronic components and related items.

“It looks like the market has finally started to pick up across the board,” one panelist reported.

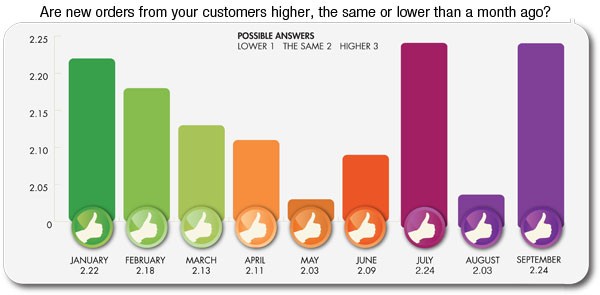

Buyers are following suit, noting that their purchasing activity increased during September. They also pointed to increasing customer orders, lower inventories, lower prices, and longer lead times during the month.

“Business continues to pick up,” said another panelist. “Some lead times and stock have gotten harder. There are many positive trends happening in the industry and we are bullish on the industry moving forward.”

Purchasing activity increased 5% compared to August, following a 6% rise in August compared to July. The new orders index jumped 10%, after falling 9% in August. The inventories index fell 7% and the prices index fell 5%, indicating that buyers are paying lower prices for the components they purchase. The lead times index rose 3% during the month.

The September GPI report follows other positive industry economic indicators recently, including a quarterly business outlook from the Manufacturers’ Alliance for Productivity and Innovation (MAPI). MAPI reported that the global manufacturing economy will grow 4% next year, following 3.4% growth this year. The report pointed to new demand for manufactured goods worldwide, with particular growth in energy infrastructure, residential and non-residential construction, transportation equipment, and the medical industry through 2016.

SPI: The Plastics Industry Trade Association reported strong gains as well, noting continued growth among makers of plastic injection molding, extrusion, blow molding, thermoforming, hot runners, and auxiliary equipment through the first half of 2014. The 10% gain reported among SPI members continues momentum from the second half of 2013, the group said.

Global Purchasing’s GPI measures purchasing professionals’ business confidence in five areas: new orders from customers; electronic component inventory levels; purchasing activity; pricing; and lead times. Global Purchasing compiles the GPI data monthly from a survey of more than 100 panel members who buy a wide range of electronic components. Prequalified for their industry experience, panel members are purchasing executives, managers, or buyers at original equipment manufacturing (OEM) or contract manufacturing firms around the world.

Source: globalpurchasing.com