Introduction:

Supercapacitors are an approximate $400 million world market that sits on the cusp of the $95 billion global battery market and the $17 billion global capacitor market. This statement has been used to entice investment for many years, because potential financiers are motivated about the total available market (TAM), which in this instance is a combined $112 billion USD. However, this also has created an identity crisis among supercapacitor manufacturers, because they do not fully appreciate if they are selling a capacitor, or a battery. And if you use battery terminology to sell a capacitor, you will end up confusing the design engineer. Therefore, supercapacitors are finding market opportunities on new platforms, where there is a need for high energy density and rapid charge, and where volumetric efficiency is not a major concern.

Figure 1.1: Supercapacitors on the Cusp of Two Big Markets in 2013

Therefore, a large number of vendors have been enticed to jump into the market over the past two decades to where we have reached the point of having too many vendors to support the little market there is and also, the fact that it has taken so very long for the market to reach a few hundred of millions of dollars. What’s more, each of the large number of vendors who participate, are convinced that they will control 30% of global share in a matter of a few years. More probably, is that the direction that other dielectrics have taken over time will be the same direction that supercapacitors will take. In short, we know our past trends in electrostatic and electrolytic capacitors, and we are destined to repeat it.

Historical Development and Market Expansion:

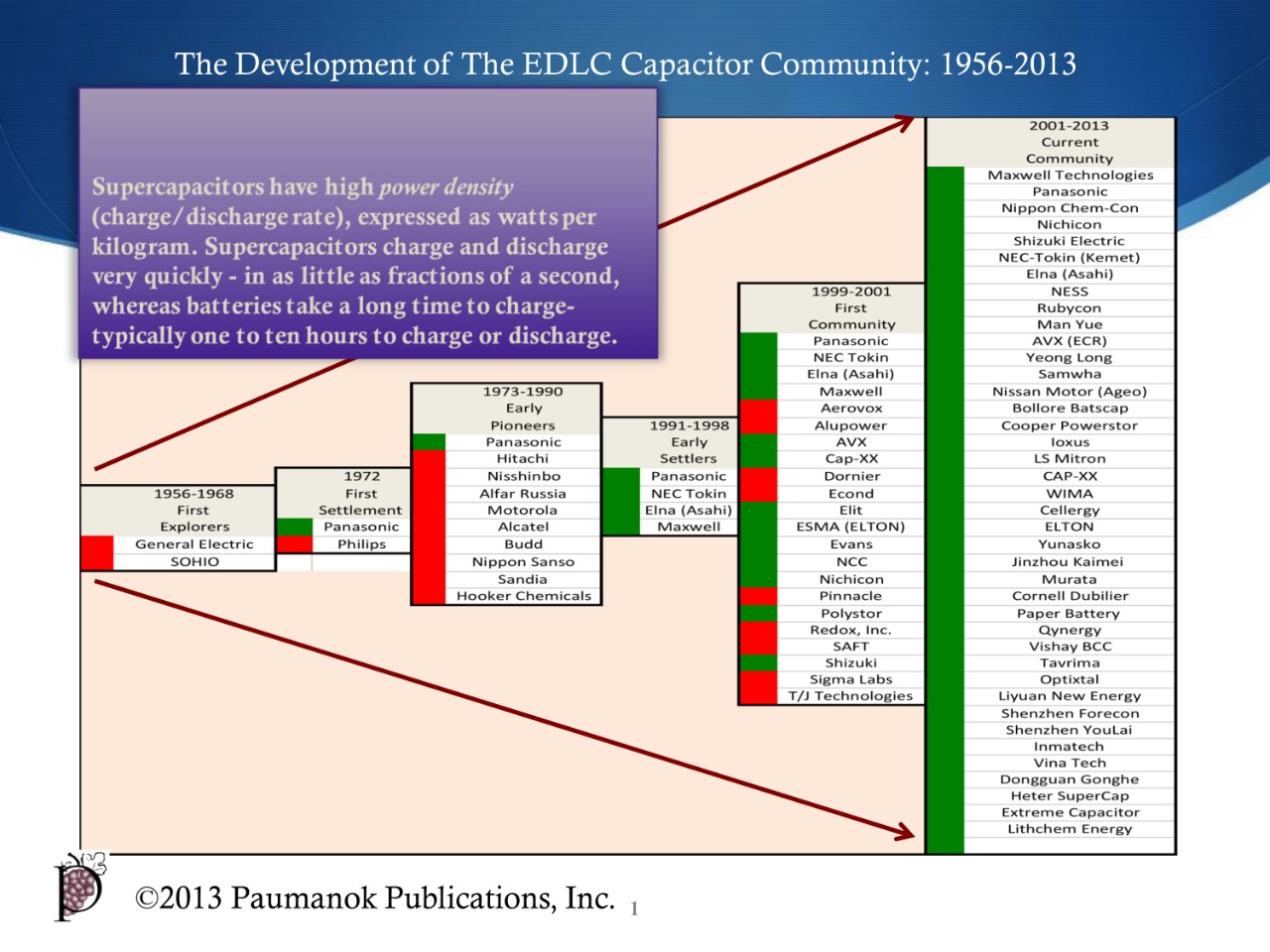

The first explorers in this market were GE and Sohio and this can be traced back using patent searches (See Figure 1.1). However, the first companies to commercialize the technology and mass produce it were Philips and Panasonic (And of course Panasonic, and their “Gold Cap” product line are still active in the business and maintain considerable market share, Philips however, is not in the business anymore).

Figure 1.2: The Development of The EDLC Capacitor Community: 1956-2013

Between 1973 and 1990 many companies in Japan and Russia began experimenting and producing a variety of small can and large supercapacitor cells whose similarities were that they had a high power density (charge/discharge rate) expressed as watts per kilogram, and a high level of energy density (for burst power). Also, they had capacitance values expressed well into the Farad range and had low voltage per cell- usually between 2.5 and 2.7 Vdc. By 1998 there were four companies that defined the market for supercapacitors, and these were Panasonic, NEC-Tokin, Elna Capacitor, and Maxwell Technologies. And between 1999 and 2013, the number of vendors supplying the global market with supercapacitors increased at a rate that far exceeded value growth in the market. And by 2013 there were 40 companies with competing in the carbon dielectric supercapacitor market worldwide (FYI According to Paumanok research data, the value of EDLC supercapacitor consumption worldwide has increased by 275%, while the number of vendors supplying the market has increased by 1,000%).

Market Migration:

One vendor criteria that stands out in the marketplace now is that the top vendors are largely either aluminum electrolytic capacitor manufactures or power film capacitor manufacturers first, and super capacitor manufacturers second. Some of the vendors here (only a few) were involved in the battery market beforehand, but an increasing number of manufacturers are stand alone vendors who have plans on producing just supercapacitors. Regardless, the most successful companies to date exhibit either longevity in the market, or they exhibit an existing capacitor dielectric, a large can electrochemical type of capacitor, for which they have existing channels of distribution and contact with customers who have an interest in expanding their consumption to include capacitors in the Farad range.

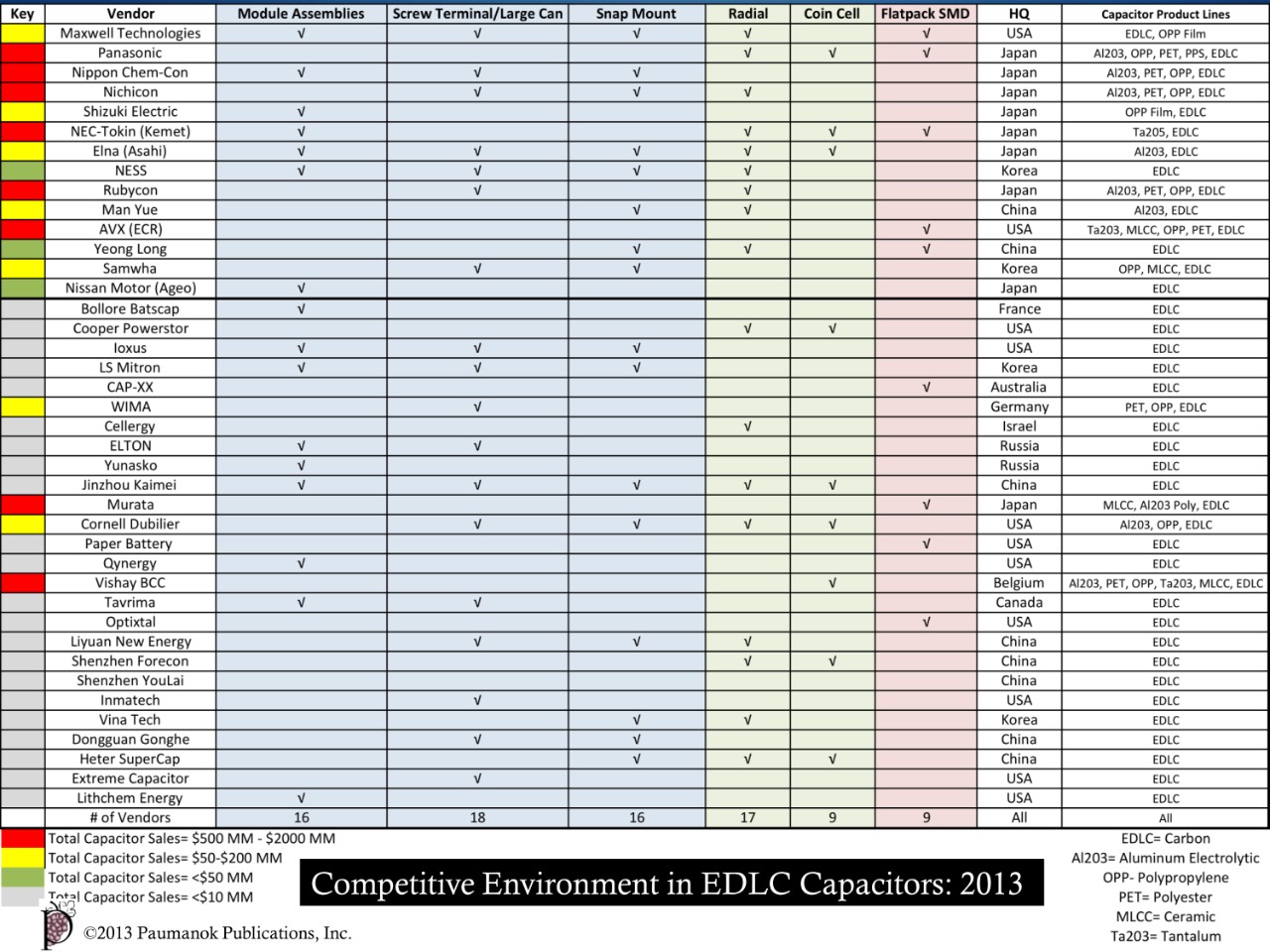

So when we look closely at the global capacitor market, on a more granular level, we can see why an aluminum electrolytic capacitor manufacturer or a power film capacitor manufacturer would want to enter the supercapacitor market, because it is a logical extension of the product line and customer access is already built into the existing business model because of their production of other dielectric capacitors. Figure 1.3 is interesting because it breaks down the market based on supercapacitor configurations by vendor, but also shows which vendors have exceptional market positions in other capacitor products. You will note that the top vendors have significant market positions in other dielectrics and therefore, most importantly, have access to pertinent distribution channels and existing customer access that lend themselves to success in selling supercapacitors. We dare say that this chart also illustrates that many stand alone vendors of supercapacitors are obtaining angel and institutional funding based solely on technology and configuration and not on the access to distribution channels and existing customers, and subsequently we conclude that the future of supercapacitors will require industry consolidation, or a significant shake-out of the weaker competitors in favor of the strong.

Real Demand Creation and Future Growth:

As Paumanok has documented the market since 1993 we note that all the growth has been in snap mount and large can configurations (this also includes the module assemblies). Where we see limited VALUE growth is in the older portion of the market- the coin cells and radial leaded products- the flat packs are just now gaining momentum and have a different business model, so the verdict is still out on how well the flatpack supercapacitor will fare as a viable load leveling solution for portable electronics – but Murata believes in it and they are the world’s largest capacitor manufacturer, so their entrance into the space should not be overlooked or underestimated.

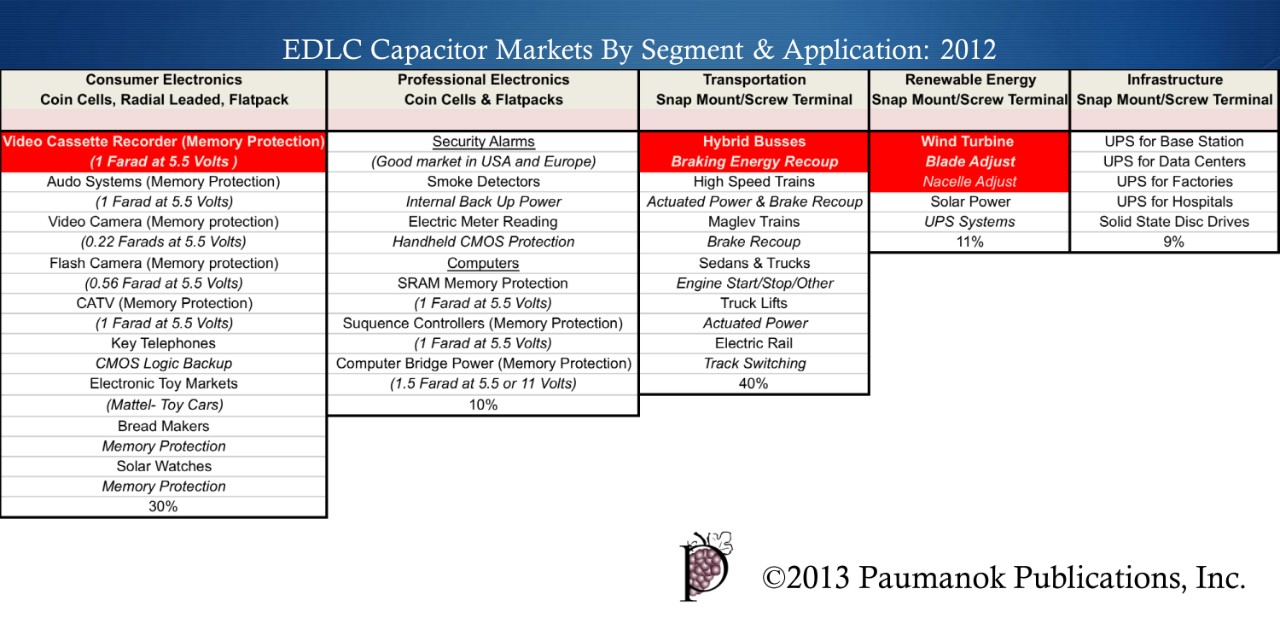

Figure 1.3 above separates the competitive environment by EDLC configuration. First, companies with large market positions in large can Al203 capacitors or large can OPP film capacitors have leadership positions in large can EDLC supercapacitor markets as well. The major vendors in the radial leaded and coin cell business are already serving the consumer electronic space either captively (Panasonic and NEC) or through sales of other capacitor dielectrics, (Elna and Rubycon). In the emerging segment, the flatpack, the molded chip and the V-chip, we have the two pioneers, Cap-XX (Intel invested) and AVX Corp. and the new entrants in surface mount EDLC supercapacitor solutions Murata and Panasonic. The area of dramatic market growth in EDLC supercapacitors over the past decade have been in new technology platforms and it has also been in the large can screw terminal and snap-mount type supercapacitor and in the supercapacitor module assembly. The key end markets for these large can products and module assemblies are in hybrid busses (for system load leveling), wind turbines (for blade and nacelle adjustment), and as UPS for solid state disc drives. Other applications exist, but these three applications are responsible for the growth we have seen in the space over the past 10 years, See Figure 1.4 below.

Figure 1.4: Supercapacitor Applications by End-Use Market Segment and Product Market: 2013M

In the EDLC coin cell and EDLC radial leaded can markets, which had dominated the market ten years ago, have become an area of extreme price competition among Japanese and Chinese vendors of the technology, computing for CMOS backup circuits in consumer electronics and bridge power applications in computers. Price competition in the small cell space has eroded the global value of this segment of the market and will most certainly continue to do so over time.

Surface mount and flat pack solutions on the other hand, hold great promise for future growth and can be considered as emerging technologies for load leveling power consumption in portable and professional electronics (Smart metering applications for example).

Disruptive Technologies:

We view the modern hybrid capacitor as potentially disruptive to EDLC supercapacitor technology because of its higher energy density and movement toward higher power density as well as its higher voltage per cell. The majority of hybrid solutions are lithium based, although we also have the Polyacene capacitor and the lithium titanate product line. These hybrid capacitors compete in the Farad range as do EDLC technologies, but their higher voltage per cell means less capacitors are required to achieve a desired voltage rating. Hybrid capacitors also remain somewhat limited in terms of their component configurations at this time, but are slowly migrating toward similar configurations as can be found in the EDLC supercapacitor lines.

The Expected Reality of Future Growth in Supercapacitors:

For about 20 years the joke among vendors in this industry was that the only companies that were making any money off of supercapacitors were market research companies who sold reports to the increasingly larger number of vendors who had entered the market, who in turn presented this third party data to financial concerns, who were impressed with the growth forecasts and made substantial investments.

Unfortunately it is highly unlikely that capacitor markets will grow to exceed a billion dollars in just five years, and truly need a long period of market acceptance and production entrenchment before they have the momentum to achieve 10 figures in global revenues. Capacitor market expansion, regardless of dielectric, is frequently tripped up by price erosion, brought about by massive competition between East and West, a battle which the East always wins because they are comfortable with extremely thin margins. Additionally, there are always disruptive and alternative technologies that erode emerging market shares as well, and EDLC supercapacitors are no exception.

Therefore we expect that supercapacitor demand will grow in value by about 30% overall between 2013 and 2018 and remain in the hundreds of millions of dollars (not billions).