New Study Sheds Light on the Affect of Section 1502 of the Dodd-Frank Law

“ENOUGH” - The Project to End Genocide and Crimes Against Humanity issued a report this month (June 2014) entitled “The Impact of Dodd-Frank and Conflict Minerals Reforms on Eastern Congo’s Conflict,” in which it draws direct conclusions between the enactment of the United States Dodd-Frank Law (properly known as the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act), the independent actions of the electronics industry in establishing closed loop mining systems and the significant reduction of armed groups controlling tantalum mining operations in the Eastern Democratic Republic of the Congo.

Dodd-Frank Law Creates Transparency in the Tantalum Supply Chain

2010 Dodd-Frank Wall Street Reform and Consumer Protection Act (also popularly known as Dodd-Frank) is a securities law; and section 1502 focuses specifically on the mining and export of tantalum and other “conflict minerals” from the Democratic Republic of the Congo (DRC) in Central Africa. The law is designed to create greater transparency in the supply chain for companies that are listed publically in the United States. Because the American Stock Exchanges (NYSE, NASDAQ) are important trading platforms for large multinational corporations that manufacture the final products that ultimately consume conflict minerals, the impact of the legislation has been broad and deep, cutting through multiple layers of the supply chain and reaching all the way back to Africa where the impact has been beneficial and significant. Major corporations that have lent their brand names to this struggle include Motorola, Intel, Apple, HP, Foxconn, Flextronics, AVX Corporation, Global Advanced Metals and KEMET Corporation.

67% of Tantalum Mines in DRC Now Conflict Free

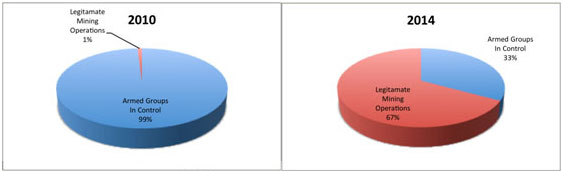

The report concludes that the Dodd-Frank Law, coupled with conflict minerals audits from the electronics industry, as well as reforms initiated by African governments in the region, have made the economics of mining tantalum too costly for armed groups to participate. The mining of four metals- tantalum, tungsten, tin and gold generated a reported $185 million US dollars in revenues per year for armed groups who had used these proceeds to purchase weapons and perpetuate the destruction of the central African nation (Paumanok estimates that tantalum ore sales were an estimated $35 million USD in revenues per year going to the Congo). However, between 2010 (the year Dodd-Frank became law) and 2014, “ENOUGH” estimates through its primary interviews of 220 people in 14 mines and towns in the DRC, as well as 32 separate interviews conducted in the United States and Europe; that armed groups are no longer present at two-thirds (67%) of the conflict mineral mines.

Figure 1: Dramatic Decrease in the Number of DRC Mines Operating as Armed Camps: 2010-2014

Source: Based on Study Findings of Enough, entitled “The Impact of Dodd-Frank and Conflict Minerals Reforms on Eastern Congo’s Conflict”

A Concerted Effort Among Government and the Electronics Industry

The report also applauds the efforts of the electronics industry, which has implemented conflict-free audits that require complete transparency of the supply chain for tantalum materials. This has forced the consolidation of the market for conflict minerals, which sell for 30% to 60% lower than prices for audited materials whose origins are traced and documented. This has created an unprofitable environment for armed groups wishing to mine and trade in tantalum, driving many of them out of the mining business entirely.

The report also cites that Intel Corporation is producing the world’s first completely conflict free material product line, and that Apple Corporation has also publically validated their tantalum supply chain as conflict free. This is encouraging other electronic product manufacturers to accelerate their own internal audits to remain competitive.

Unsuccessful Attempts to Challenge

The “ENOUGH” report also voices some concerns about the continued success of the Dodd-Frank legislation, citing that special interest lobbying groups, the United States Chamber of Commerce, the Business Roundtable and the National Association of Manufacturers filed a lawsuit (The case was National Association of Manufacturers versus U.S. Securities and Exchange Commission, 12-1422, U.S. Court of Appeals for the District of Columbia Circuit) against the United States Security and Exchange Commission challenging the wisdom and legality of Dodd-Frank.

The U.S. Chamber of Commerce, the Business Roundtable and the National Association of Manufacturers, filed the lawsuit together and believe that the legislation is not an effective approach to the complex issue of conflict minerals, and that it imposes an unworkable, overly broad and burdensome system that will undermine jobs and growth and may not achieve Congress’s overall objectives. Therefore, it is their wish that the rule be modified or set aside in whole or in part. The National Association of Manufacturers, the Business Roundtable and the U.S. Chamber of Commerce claimed in their suit that being required to publish conflict mineral disclosures on their own websites is compelled speech that violates the First Amendment of the U.S. Constitution.

In July 2013, a Federal Court under U.S. District Judge Robert Wilkins in Washington DC found no problems with the SEC’s rulemaking and disagreed that the section 1502 ‘conflict minerals’ disclosure scheme transgressed the First Amendment, the court concluded that plaintiff’s claims lacked merit and dismissed the case.

Still, however, “ENOUGH” remains concerned that future lawsuits, perhaps under a different executive administration in the United States might be successful, and feel that any modification or revocation of Section 1502 of the legislation could have catastrophic results for the Congo.

Targeting the Smelters

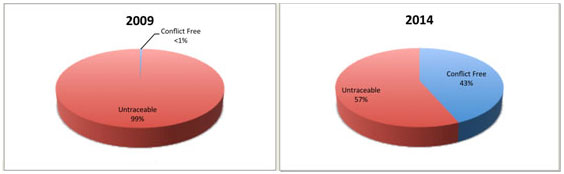

Since tantalum requires smelting in an industrial processing facility, the key area of focus in determining where materials are sourced are the smelters. Therefore, to help the supply chain comply with Dodd-Frank, the industry established the Conflict Free Smelter Program (CFSP), which uses independent auditors to determine which smelters have safeguards in place to ensure they do not purchase conflict minerals. In 2009, when the CFSP program was first established, only one smelter out of an estimated 200 were determined to be conflict free, however, today, with the help of Dodd-Frank and the internal pressure placed on the smelters by the electronic component industry, that number has increased to 87 smelters (43%) who have been determined to be 100% conflict free.

Figure 2: Increase in The Number of the World’s Smelters Designated “Conflict Free” 2009-2014

Source: Based Upon Study Findings of Enough, entitled “The Impact of Dodd-Frank and Conflict Minerals Reforms on Eastern Congo’s Conflict”

Closed Pipe, Conflict Free Supply Chains

As mining operations in the DRC have steadily been placed under civilian rather than military control, the country has become more attractive to electronics manufacturers to more freely source and invest in the region. Today, according to the “ENOUGH” Study- there are 21 electronics and other companies that are now sourcing tantalum and related minerals from “closed-pipe conflict-free” supply chains. The report cites these specific examples of positive initiatives organized by electronics manufacturers-

- The Solutions for Hope tantalum mining operations in northern Katanga province, which was initiated by Motorola Solutions, AVX Corporation and F&X in 2011, now includes 14 companies with such major brands as Intel, HP, Nokia, Foxconn and Flextronics. The Solutions for Hope Project was launched as a pilot initiative to source conflict-free tantalum from the Democratic Republic of Congo (DRC). The Solutions for Hope Project’s unique approach to mineral sourcing in the region utilizes a closed-pipe supply line and a defined set of key suppliers – mines (including artisanal cooperatives), smelter/processor, component manufacturer and end user – identified in advance of initiating the project. Miners in Solutions for Hope sponsored in Katanga, for example, have seen the price of tantalum triple since 2011 (at the Rubaya and Kalimbi mines). According to the Solutions for Hope website, the project has resulted in the shipment of 320,000 pounds of tantalum ore through June 2013.

- “Solutions for Hope 2” is the expansion of the above-mentioned program and includes tantalum mines in North Kivu begun by Motorola Solutions, AVX, and MHI, and now includes 12 companies, including Global Advanced Metals, which will be processing powder and wire from the tantalum ores mined in the Congo.

- KEMET’s “Partnership for Social and Economic Sustainability in northern Katanga (2012)”. KEMET Corporation, a major producer of tantalum capacitors development the Partnership for Social and Economic Sustainability model based on tantalum ore from the DRC, culminating in a closed-pipe, vertically integrated conflict-free tantalum supply chain. This chain begins with tantalum ore sourced from the conflict-free Katanga Province of the DRC, through processing and smelting, and finishing with the delivery of conflict-free capacitors to the customers. The KEMET model begins in the Kisengo Mine, Katanga Province DRC where tantalum ore is mined and washed. The miners have their individual contribution of concentrate weighed by a representative from the International Tin Research Institute Tin Supply Chain Initiative (iTSCi). All contributions are logged, consolidated into mine bags and brought to the Coopérative des Artisanaux Miniers du Congo (CDMC) depot. The mine bags are then consolidated into larger “negotiante” bags and tagged. The negotiante bags are placed in steel drums and exported to KEMET Blue Metals in Matamoros, Mexico, where the ore is processed into K-Salt, a necessary intermediate product. All information continues to be carefully logged by iTSCi. The K-salt is then shipped to KEMET Blue Powder Corporation in Carson City Nevada, where it is processed into capacitor grade powder. This tantalum capacitor powder is then shipped to KEMET’s Matamoros, Mexico, plant for the production of tantalum capacitors. The finished capacitors are then shipped to customers around the world.

Summary and Conclusions:

A concerted effort among government and industry, including the enactment of the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act and the establishment of the Closed Loop System, have been cited in a new report by “ENOUGH” an international activist group, entitled “The Impact of Dodd-Frank and Conflict Minerals Reforms on Eastern Congo’s Conflict,” as being successful in mitigating the exploitation of tantalum mining in Eastern Congo. The report cites that 67% of the mines operating in the Congo are now free from the control of armed militant groups, up from 1% in 2010, and that 43% of the world’s smelters have been designated “conflict free”, up from only 1% in 2009.