Analysts predict that by the end of 2015 that 15 billion devices will form the framework for the IoT, and this will increase by 235% to 50 billion devices by 2020. In the near-term, the majority of these connected devices will be wireless handsets and computers, but a bevy of new and interesting electrical and electronic products have been introduced to suggest that a truly connected world is right around the corner.

The similarity among these products is that they are all accessed and manipulated by technology (i.e. smartphone, tablet, notebook, desktop computer) through the internet which gives the consumer unprecedented access to monitor and control themselves and their environment.

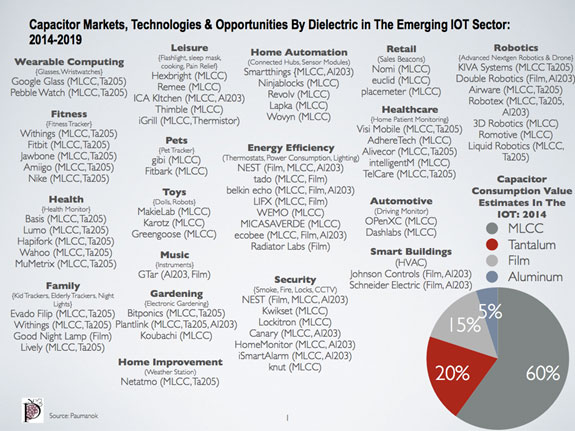

A close look at the vendors of emerging IoT products gives us a unique perspective on the components they require to operate. This article sheds light on the types of capacitors currently being used for the new internet of things and why.

Dichotomizing the Growing List of IoT Devices:

The number of manufacturers offering new and interesting products that can be considered part of the “Internet of Things” has been growing over the past two years. It is important at this point in the IoT market development to begin to categorize individual product lines so that a vision of the future can be adequately developed. Still, it is important for the reader to understand that this is a static picture in a rapidly developing market, and it will be interesting to see how many additional product branches sprout from the IoT over the next five years. It is also important for the reader to understand, that other big picture concepts such as wearable electronics, home automation, robotics and smart buildings are also in fact part of the IoT.

- Wearable electronics can further be dichotomized into wearable computing, which includes such products as spectacles and watches; but the wearable segment also has branched out to include fitness trackers, health monitors, pet trackers, and family trackers. Because these designs are wearable, component volumetric efficiency is paramount, and therefore we see ultra-small case size multilayered ceramic chip capacitors and ultra-small tantalum chip capacitors as the primary dielectric products being consumed here for bypass, decoupling, smoothing and pulse discharge. Products designed for the consumer that are difficult to categorize, but can be considered extensions of the consumer include electronic musical instruments, flashlights, sleep masks, cooking products and pain relief electronics.

- Once again, the similarity among these products is not that their functionality is unique, but that they can be monitored and manipulated through internet access. For capacitor manufacturers, the wearable electronics segment does not necessarily pose a lucrative market. The “wearable” nature of the product limits their component content, and even then, the footprint of the components consumed support the lowest priced components on the market. There may be an initial premium for capacitor manufacturers who can mass produce extremely small, almost microscopic capacitors for consumption in wearable electronics, but the total available market remains limited to the function of global population, and small component content in wearable designs.

Wearable Electronics and Related Product Lines:

- In addition to products for the individual consumer, there are a myriad of connected products being developed for both the business and the residence, including home automation, energy efficiency, security, healthcare, gardening, patient monitoring, smart buildings and retail sales connected electronics. These product lines have much greater potential for dollar sales and profitability for capacitor manufacturers.

- Internet connected electronics for dwellings in the IoT include such unique and interesting products as electronic gardening, home weather stations, connected hubs and sensor modules, thermostats, smoke detectors, fire detectors, locks and closed circuit TV; heating and ventilation systems and retail sales beacons. Many of the IoT dwelling related products being introduced are hardwired into the dwelling’s electrical system and therefore have unique requirements for capacitors.

- We most certainly see a pattern requiring high voltage ceramic capacitors, but we also see the requirements for plastic film interference suppression capacitors (X&Y) and AC and Pulse plastic film capacitors, as well as the growing requirement for radial leaded and V-chip aluminum electrolytic capacitors. Even though the total available market for dwellings worldwide is in the hundreds of millions, the redundancy requirement of dwelling related electrical and electronic products makes the component content attractive to capacitor manufacturers, especially film capacitor and aluminum electrolytic capacitor manufacturers who are used to supplying fragmented end-markets in small comparable volumes. Subsequently the IOT is of great interest and stands to have a considerable financial impact for film capacitor and aluminum electrolytic capacitor manufacturers worldwide.

Dwelling Electronics and Related Product Lines:

- To date the only consumer related robotic product to really take off has been the robotic vacuum cleaner; however, new products based on advanced robotics and drone technology will make their debut and be connected to the IoT. These advanced robotic systems can be employed to enhance factory automation (The mobile robots navigate around the warehouse by following a series of computerized barcode stickers on the floor); “double robotics” or basic clones of people that are designed to do basic tasks at one office location while the consumer is at another location; there are also companion robotics already on the market, as well as a bevy of commercial drones currently being offered to the market- all connected and all operational over the internet. Advanced robotic systems require tantalum capacitors, aluminum capacitors and ceramic chip capacitor to operate. Moreover, many of the capacitor products required to operate robotic systems are the larger case size, high voltage or higher temperature capacitor product lines that have price premiums. Therefore, the robotic portion of the IoT is also attractive to capacitor manufacturers who specialize in value-added and application specific segments of the market.

Advanced Robotics and Drones:

- We are also monitoring the beginning of activity related to the connection of automobiles to the internet, with the first products on the market being developed for driver monitoring. Many of the modules that are plugged into the car to connect the automobile to the internet employ mostly standard ceramic chip capacitors.

Automotive Products:

Capacitor Products for the Emerging IoT Market:

- Based on our detailed analysis of the emerging IoT products that have already made their way to the market, we can see that approximately 60% of the value associated with capacitor purchases are for ceramic capacitors. This is because many of the products being produced have volumetric efficiency issues because they are wearable or are designed to be extensions of the consumer’s environment, and therefore require the ultra-small case size parts that are only available in the MLCC case sizes (i.e. EIA Case Sizes 0201, 01005). There is also the application of high voltage ceramic safety capacitors for applications in IoT related dwelling electronics.

Ceramic Capacitors (60%):

- The other dielectric being consumed for the emerging IoT is the ultra-small case size tantalum chip capacitors (i.e. EIA “P” and “J” case size chips) which represent an estimated 20% of the value for all capacitors consumed in the emerging IoT products being primarily for products in the wearable electronics segment, and larger case size tantalum chips being consumed for applications in IoT connected advanced robotics and drone designs.

Tantalum Capacitors (20%):

- Plastic film capacitors also are being consumed in many of the hardwired dwelling related IOT products. Many of the smoke detectors, thermostats, and lighting related designs, which are all being sold based on increased energy efficiency require X and Y plastic film capacitors and AC and Pulse film capacitors to operate safely. We believe that IoT related devices hold great promise for the future of plastic film capacitors, especially interference suppression and AC/Pulse type polypropylene film capacitors.

Plastic Film Capacitors (15%):

- Dwelling related IoT products also require some aluminum electrolytic capacitors, especially for alarms, CCTV, and robotics.

Aluminum Electrolytic Capacitors (5%):

Outlook for Capacitors in Emerging IoT Markets to 2025:

The reader should appreciate that analysts are calling for a 235% increase in the number of products being produced that will be connected to the internet and monitored and controlled via smartphone between 2014 and 2020. This represents a significant growth opportunity for the manufacturers of capacitors, especially profitable capacitor products such as high voltage ceramic capacitors, ultra-small case size tantalum chips; interference suppression film capacitors, AC and Pulse film capacitors and V-chip aluminum capacitors.