FY 2016 Market Shares: Observation on Shifts

The fiscal year ending March 31, 2016, has proven to be an unusual economic year in the history of tracking the global capacitor, resistor and inductor markets worldwide. The market environment is succumbing to the impact of forces that are both internal and external to the supply chain and almost every company in the world selling electronic components took a beating in the markets in the last fiscal quarter, unless you were selling to specific manufacturers in China who in turn were building specific types of smartphones. The real crack in the armor came mid-March 2016 when a key industry executive asked me to do a quick analysis on nine month year-on-year sales cycles for components sold into the automotive industry, as there was conflicting information about just how hot the automotive end market really was; as every piece of literature (including my December MarketEYE article) promoted the positive market opportunities for passenger compartment electronics in the coming years. The conclusion of the research was that the market was growing and declining at the same time, growing in yen and declining in US dollars, because of the rapid frequency by which the yen has been weakened on a year-over-year basis. This is having a significant impact on the year-over-year changes in market shares at each granular level of passive component. However, the research also pointed to two additional criteria that were market driven that were having an even greater impact on shifts in global market shares. These included issues related to market access (product line, end-market, region) and specific customer access within segments in FY 2016.

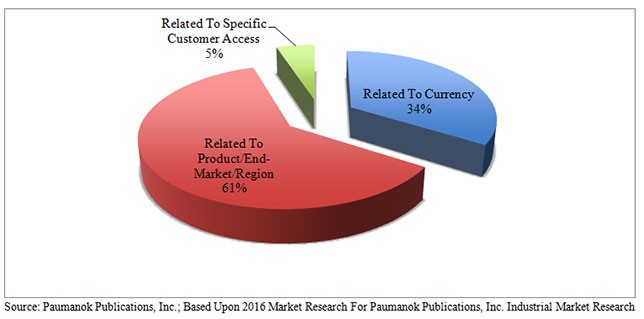

Criteria Impacting Market Shares in the Global Passive Component Industry in FY 2016

Changing global market shares in the passive electronic component industry in FY 2016 can be attributed to the following criteria:

- RELATED TO CURRENCY:

- Changes in currency valuations, especially the weakening of the yen during the fiscal year had an impact by favoring Japanese vendors.

- RELATED TO THE MARKET:

- Specific product mixes, end-market access and regional access contributed to changes in market shares in FY 2016.

- RELATED TO CUSTOMER SPECIFIC:

- Customer specific access within key channels also impacted market shares in FY 2016.

See Figure 1.1 Below…

Figure 1.1: Reasons for Changes in Market Shares in The Passive Component Industry in FY 2016

Impact of Weakened Currency on Market Shares in FY 2016:

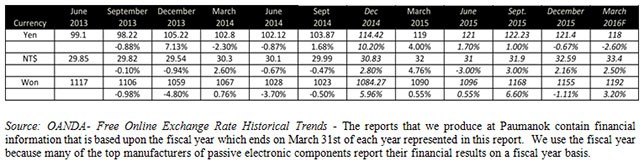

The following chart shows the trend of three major currencies to the US dollar. The reader will note that the yen to dollar ratio has changed substantially. Annualized for FY 2015 the yen to dollar ratio was 106.8 and this shifted dramatically in FY 2016 to 121.6 (a 14% Y0Y increase in strength of the dollar to the yen- see Figure 1.2)-

Figure 1.2: Currency Translations Used in this MarketEYE Article: FY 2013, 2014, 2015 and 2016 (Yen, NT$ and Won Currencies to the United States Dollar Quarterly Exchange Rates)

Yen Valuation to the US Dollar: Trend and Directions for the March and June 2016 Quarters:

The yen was weakened substantially between June 2013 and March 2016 when compared to the US dollar. In short, the value of the yen went from 99.1 yen to one US dollar in June 2013 to an estimated 118 yen to one US dollar in March 2016. The Japanese yen, and the rapidity and frequency by which it changes, is important to this the passive component industry because many of the top vendors of passive components in the world, including Murata, TDK, Taiyo Yuden, Nippon Chemi-Con, Nichicon, KOA, Sumida, and TOKO report their revenues in Japanese yen. In fact 54.8% of the world’s passive component manufacturers report their revenues in yen (up from 53.7% in FY 2015).

NT$ Valuation to the US Dollar: Trend and Directions:

The New Taiwan dollar has remained remarkably stable between June 2013 and March 2016, however we note a new weakening in the NT$ in the March 2016 quarter and we expect this to continue into the June 2016 quarter- on a quarter-to-quarter basis. The New Taiwan Dollar is important to this report because two of the top vendors of passive components in the world- Yageo Corporation and Walsin Technology Corp. report their revenues in NT$.

Won Valuation to the US Dollar: Trend and Directions:

The South Korean won has also weakened in the March quarter and we expect further weakening in the June quarter. Our primary sources in Korea site a significant setback in the re-evaluation of the China handset business for FY 2017. We are interested in the won valuation because Samsung Electro Mechanics is a major vendor of passive electronic components.

Changes in Market Shares Due to Product Mix and Market Access: FY 2016

Another more important criteria that is impacting the vendor market shares in passive components in FY 2016 is related to product mix and market access.

- Product Mix:

- Detailed product research by Paumanok Publications, In., for FY 2016 has revealed that when measured in US dollars, all markets for passive components declined in FY 2016 on a year-over-year basis, except for high capacitance MLCC and discrete inductor chip coils.

- Customer Access:

- Access to specific end-customers in FY 2016, especially customers in the smartphone production business in China was a key to increasing market share, while a larger overall percentage access to end-markets such as computers and consumer AV created a loss in global market share.

- Regional Access:

- With respect to regional demand for components, news out of China in early 2016 caused the market to pull back. Forecasts for everything from handsets to automobiles to be consumed in Greater China in FY 2017 were revised downward. The backlash on the component supply chain, with one of our massive customers in Asia, who seldom comments on their financial results, noted “they were surprised by the rapid decline in the December 2015 quarter (believe me, coming from such stoic players, it screams volumes!). We noted that the European economy showed signs of recovery early in FY 2015 (with our German customers and UK customers having clear opportunities in the automotive electronics space, but we learned later on only manufacturing product for the USA market), therefore the recovery was painfully slow; lower fuel prices crippled the recovering renewable energy market; the emerging economies global investment dried up leaving dreams of power transmission and distribution projects for later years; and the once thriving oil and gas electronics market looked toward the past needing therapy, and could only make limited guesses of FY 2018 for an expected turn around in the global oil and gas markets- and the overall result remains one of continued stagnation and corporate frustration.

Changes in Market Share Due to Access to Specific Customers by Channel:

There was also a criteria for increased market share in specific niche segments of rapid growth industries, such as decoupling microprocessors in Apple and Samsung smartphones. And this requires a strategy and level of planning that is not evident in all manufacturers of passive components. It also requires an advanced commitment to research and development. Another interesting finding of Paumanok research is that there is a direct correlation between market leadership and the percentage of revenues spent on research and development. For example, the vendors of high capacitance MLCC and discrete SMD chip coil inductors, which we noted as growth businesses in FY 2016, required a commitment in the advanced development of capacitance and nanohenries in exceedingly smaller components, and the ability to convince major customers in the smartphone supply chain (including semiconductor and plug in modules) that you have theories to move the technology forward to keep pace with the more important developments in active components. As a key passive component friend at Intel noted to me, “How can I plan to improve my product without a way to decouple it?”

Changes in Passive Component Market Shares by Sub-Category: FY 2016

The following describes my impression of each sub-segment of the passive component market-

- Capacitor Market Shares:

- Based on measurements taken each year between FY 2013 and FY 2016 we can see the impact of currency exchange on market share. Japanese companies, such as Murata Manufacturing Limited of Japan, increased its overall share of the worldwide capacitor industry substantially between FY 2013 and FY 2016; with the company experiencing some of the best quarters in the existence of the company. And while Murata does point out that they are well positioned in supplying components to the handset business- a segment which accounted for 62% of company revenues in FY 2016; and that part of that success is through their tremendous sales channels into China (64% of company revenues in FY 2016); they also note that the yen value has weakened against other world currencies, and this is partially responsible for the rapid rise in earnings for FY 2016. Meanwhile, western vendors of capacitors, such as AVX, Vishay and KEMET all lost share in the global capacitor business, with their year-over-year capacitor sales dropping by double digit percentage rates. These same Western companies dropped by between 10% and 15% in revenues in each world region; making the impact of the strong dollar felt in China, Asia, Europe and the Americas. Western companies were most impacted by declines in the computer market segment and the consumer AV market segment in FY 2016, both of which registered year-over-year declines in component sales of 15% and 30% year on year. Other vendors who lost share included the Korean vendors, who have also been hard hit by the yen weakening to the won and which has created a difficult market environment for MLCC manufactured in Korea to compete against MLCC manufactured in Japan in the China handset markets.

- Resistor Market Shares:

- In the aggressive linear resistor market we noted a slight shift in market shares resulting from the weakened yen, but this manifested itself in an aggressively competitive year for continued control of the thick film chip resistor business in China. Ironically we note that Chinese vendors such as Yageo Corporation, Walsin Technology Corp. and TA-I Corporation continue to increase market share in linear resistor markets worldwide while Japanese vendors such as KOA Corporation, Panasonic Industrial Corporation, Hokuriku Electric and Rohm Corporation are either just maintaining share or losing share in resistors over the past three years. Primary manufacturers of resistors estimate that linear resistors have lost the most value of the passive component product groupings in FY 2016 because the yen devaluation touched off a price war in China that devastated price and crushed market value. Vishay Intertechnology, Inc. has maintained market share leadership position for all linear resistors in terms of dollar value by controlling myriads of specialty resistor product lines that have been consumed through acquisition, including multiple vendors of wirewound, nichrome and network resistors

- Discrete Inductor Market Shares:

- The discrete inductor market is claimed as a subset of both the passive electronic component industry (capacitors, resistor and inductors) and is also claimed as a subset of the global magnetic devices industry (Transformers, Magnets and Inductors). It is an interesting business segment because its two large segments in handsets and automobiles have been undergoing a rapid change toward communications of subsystems in the automobile and to manage the internet of everything. Therefore we see interesting activity in the inductor market as one obvious trend is that portability creates noise on a small level among devices that must be managed and mitigated and noise protection becomes a significant trend. In this environment discrete inductors outperformed other components in FY 2016. Because of its channel focus on handsets and automobiles, the discrete inductor market performed comparably well in 2016 (still down in US dollars year-on-year; but not by much); but was dealt a crippling blow in the dramatic decline in demand from the computer markets on a year-over-year basis. Another counterintuitive point associated with discrete inductors is that they are finding markets in 4K TV sets, and thus are the only narrow segment that is reporting growth in the consumer AV segment for FY 2016.

A Pivotal Year for Passive Component Markets:

Two conclusions can be drawn from my latest research on the impact of currency devaluation on market share, and there is 1) no question that one previous unknown impact of Japanese economic policy is that its companies gained market share in international growth markets because of weak currency. And 2) the strategy of weakened currency coupled with other market accelerators, such as having the right product at the right time for the right company in the right country; served to accelerate market share gains of certain Japanese companies who demonstrated multiple perspectives to strategy (and this it can be argued is why high capacitance BME MLCC markets grew in FY 2016 as did chip coils; because they were being channeled into the smartphone production factories in China).

But now it becomes even more important to forecast the future because the developments at each level of the supply chain are becoming more intense. Smartphone growth will slow and prior year-on-year growth rates for passives will also slow. The years of 50% unit growth in support of specific smartphones are over.

Vendors will most certainly look to either leverage their brands and promote additional products with access to new TAMs (Total Available Markets), or they will find specific customers within narrow growth portions of stagnant channels to boost their year-on-year performance. Eventually we see a significant opportunity for consolidation in the industry due to the massive cash reserves at some vendors and the desperate need for cash at other vendors. You put those two together and the future spells consolidation, attracted by the return on investment through the combination of SG&A.