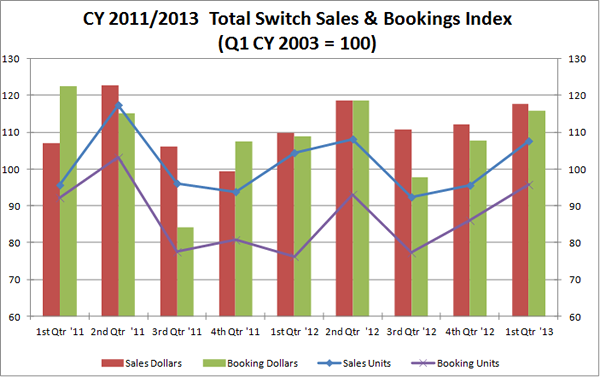

Total reported sales for all switch categories in North America for Q1’13 were 5% higher than the previous quarter and 7% better than observed in the first quarter of 2012. Sales units for Q1’13 came in 13% more than Q4’12 and 3% better than Q1’12.

The total booking dollars reported for all switch categories in North America for Q1’13 ran 7% more than the previous quarter and above Q1’12’s total bookings by 6%. The second quarter’s book-to-bill ratio for dollars was 1.018. Booking units in Q1 2013 were up 11% from Q4. The first quarter’s book-to-bill ratio for units was 0.992.

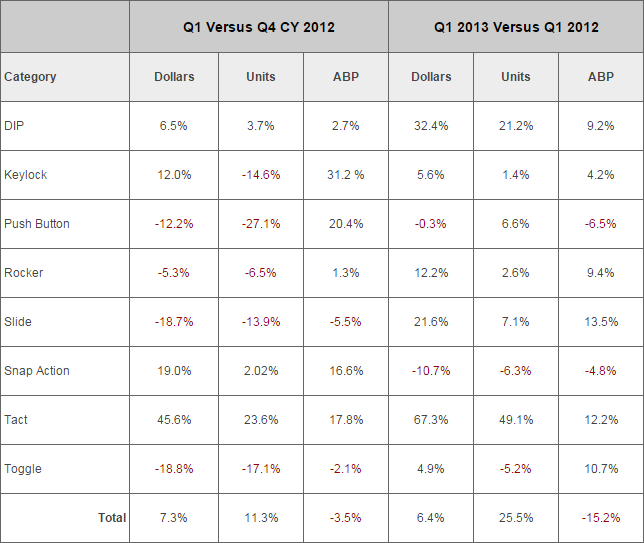

The first quarter versus the fourth showed total sales dollars up 5% and units higher by 13%. All but DIP, push button, rocker and slide experienced dollar increases. Five of eight switch categories realized lower unit sales and prices. The total ASP slipped by 7%. The comparison to the first quarter of 2012 yielded better results with dollars up in six of eight categories and 7% in total. Units were up for four categories and better in total by 3%. Pricing from a year ago was up in five of eight categories and in total by 4%.

Sales Growth by Switch Category

|

||||||

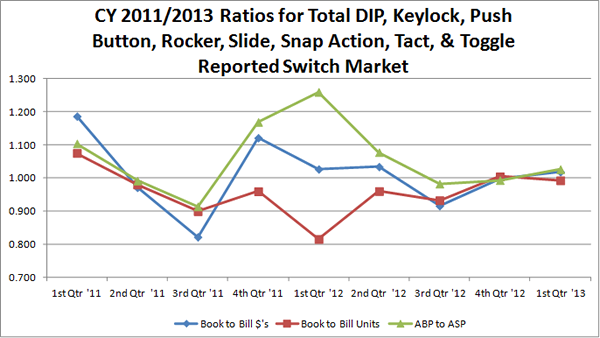

The graph below shows total quarterly indexed sales and bookings in dollars and units for the reported data since Q1 CY’11. All measures except booked dollars peaked in Q2’11 then dropped sharply in Q3. Sales continued lower in Q4 while booking dollars jumped. The first half of 2012 saw improvement in all metrics then a significant drop in Q3 with some improvement Q4 and again in Q1.Bookings Growth by Switch CategoryWhen compared to last quarter total booking dollars and units increased 7% and 11%. Dollars were up in half of categories and units rose in three of eight categories. Booked prices were up for a majority of types but down about 3% in total on a mix shift to lower priced switches. Booked dollars in Q1against the same quarter of 2012 were up for most categories and in total by 6%. Units were also up for most categories and by over 25% in total. Prices showed six of the eight categories increasing and the total moved 15% lower due to a mix shift to lower priced product.

Book-to-bill units have generally trended lower through Q1’12, then improved through Q4’12. Book-to-bill dollars have shown a similar trend with more amplitude. The booking to selling price ratio had been trending lower until Q4’11, peaking in Q1’12 then moved lower for two quarters and stabilized in Q4 then improved in Q1.

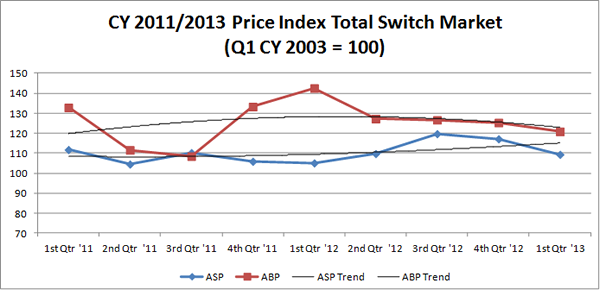

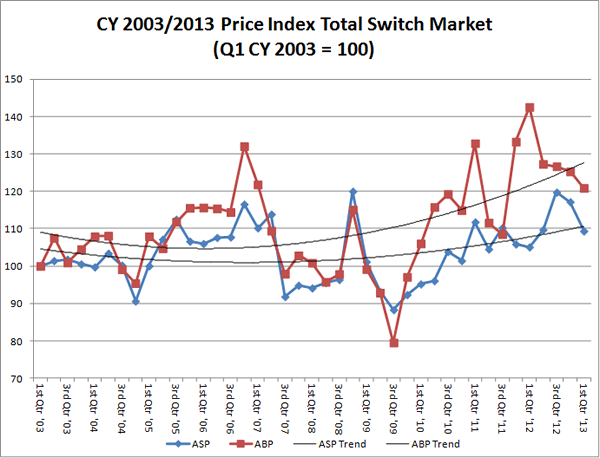

Indexed booking prices generally trended lower through Q3’11, jumped back up in Q4 and peaked in Q1’12 then fell in Q2 and held fairly steady in Q3, Q4, and Q1 of this year. Indexed selling prices have followed a similar but slightly lower path until Q3’11 when booking prices moved below it. From the end of 2011 booking price had been above selling and converged in Q3’12. The second price graph shows prices indexed since Q1’03 and both the selling and book prices have risen from all time lows set in Q3’09. Selling prices have increased to the highest level ever recorded in Q3’12 but have since fallen.