Total reported sales for all switch categories in Europe for Q3’13 were 1% below the previous quarter and 3% better than the third quarter of 2012. Sales units for Q3’13 came in about equal to Q2 and 8% better than Q3’12.

The total booking dollars reported for all switch categories in Europe for Q3’13 were 6% less than the previous quarter and above Q3’12 by 8%. The second quarter’s book-to-bill ratio for euros was 1.015. Booking units in Q3’13 equaled ran 4% lower than Q2. The second quarter’s book-to-bill ratio for units was 0.898.

The third quarter versus the second shows lower rates for the majority of categories and down 1% in total. Units were about equal in total but down for most categories. The average selling prices (ASP) decreased in over half the categories and fell 1% in total. Q3 compared to a year ago shows gains in euros for four of eight categories and a 3% rise in total. Units were up 8% in total with increases in five of eight categories. ASPs decreased for six of the eight categories and 8% in total. Year-to-date sales euros were up slightly with losses in over half the categories while units were up 3%. Selling prices were down for all categories and over 3% in total.

Sales Growth by Switch Category

| Q3 2013 Versus Q2 2013 | Q3 2013 Versus Q3 2012 | YTD 2013 Vs. YTD 2012 | |||||||

| Category | Euros | Units | ASP | Euros | Units | ASP | Euros | Units | ASP |

| DIP | 1.3% | 3.9% | -2.5% | 12.3% | 16.4% | -3.6% | 5.3% | 9.6% | -4.1% |

| Keylock | 1.5% | 21.0% | -16.1% | 9.8% | 39.4% | -21.2% | -3.9% | -3.4% | -1.8% |

| Push Button | -3.6% | -3.7% | 0.0% | -2.9% | -9.3% | 6.9% | -4.7% | -2.8% | -2.1% |

| Rocker | -6.9% | -2.2% | -4.8% | -7.5% | 1.0% | -8.4% | -5.0% | 0.7% | -5.7% |

| Slide | 2.0% | -12.3% | 16.3% | -3.7% | -0.7% | -3.0% | 5.5% | 12.1% | -7.4% |

| SnapAction | -1.5 % | -5.2% | 3.9% | 4.9% | 2.6% | 2.2% | -0.1 % | 1.1% | -1.1% |

| Tact | -0.4% | 3.9% | -4.1% | 6.2% | 14.3% | -7.1% | 4.3% | 4.2% | -0.1% |

| Toggle | 2.8% | 7.4% | -4.2% | 7.4 % | 8.1 | -0.7% | 3.2% | 1.2% | 1.9% |

| Total | -1.4% | -0.2% | -1.2% | 3.3% | 8.5% | -4.7% | 0.5% | 3.2% | -2.6% |

When compared to the last quarter total bookings were lower in euros for six of eight categories and in total euros were down 6%. Units moved down in five categories and 4% in total. The average booking price fell for six categories and 3% in total. Bookings in Q3 versus a year ago were up in euros for five categories and 14% in total. Units were up 16% in total with all but slide and toggle increasing. The total average booking prices compared to the same period a year ago was down 2% in total and in four of the categories. This year-to-date compared to 2012 shows booking euros and units up 8% with the average booking price nearly unchanged.

Bookings Growth by Switch Category

| Q3 2013 Versus Q2 2013 | Q3 2013 Versus Q3 2012 | YTD 2013 Vs. YTD 2012 | |||||||

| Category | Euros | Units | ABP | Euros | Units | ABP | Euros | Units | ABP |

| DIP | 27.8% | 20.9% | 5.7% | 22.0% | 21.9% | 0.1% | 3.4% | 2.6% | 0.9% |

| Keylock | 2.3% | -19.5% | 27.1% | 10.4% | 8.5% | 1.8% | 27.7% | 37.8% | -6.5% |

| Push Button | -3.2% | 13.2% | -14.6% | 2.9% | 1.4% | 1.4% | -0.8% | -1.4% | 0.4% |

| Rocker | -15.9% | -0.5% | -15.4% | 17.4% | 6.2% | 10.5% | 5.9% | -3.5% | 10.1% |

| Slide | -20.4% | -19.0% | -1.7% | -16.5% | -12.7% | -4.3% | 12.4% | 3.8% | 7.2% |

| Snap Action | -4.8% | 6.2% | -10.3% | 21.5% | 21.5% | -0.1% | 11.5% | 7.6% | 3.7% |

| Tact | -22.6% | -13.8% | -10.2% | -9.5% | 7.0% | -15.4% | -1.8% | 9.2% | -10.2% |

| Toggle | -18.7% | 2.0% | -20.3% | -25.9% | -9.6% | -18.0% | -7.1% | -13.9% | 7.2% |

| Total | -6.2% | -3.6% | -2.7% | 13.7% | 15.9% | -1.8% | 7.8% | 8.1% | -0.4% |

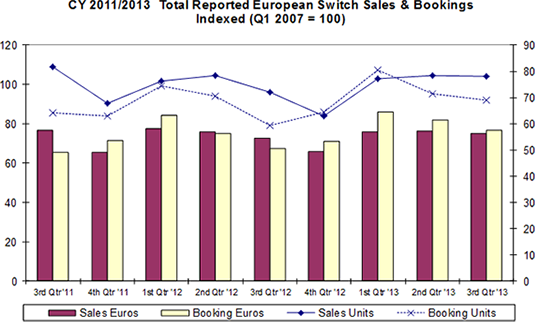

The graph below shows total quarterly indexed sales and bookings in euros and units for the reported data since Q3 CY 2011. Sales and booking euros and units were at two-year highs in Q2’01 then all moved lower the next two quarters. All measures improved in Q1’12 but moved lower again through the rest of the year. The first quarter of this year had a nice move up for all metrics. In the second quarter sales improved slightly as bookings decreased followed by a decrease in all measures in Q3.

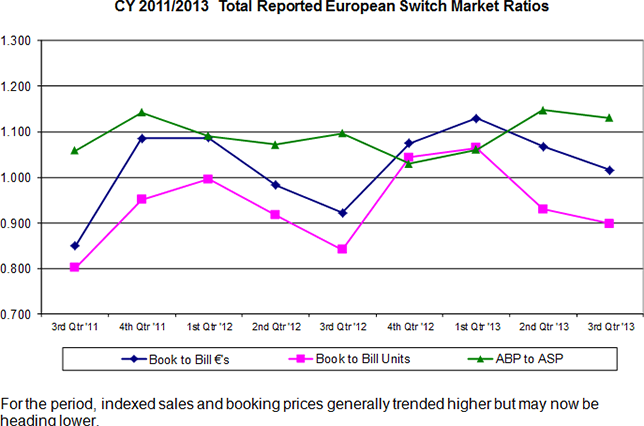

Book-to-bill euros generally declined to a low in Q3’11 improved the next two quarters only to move down in Q2 and Q3 of last year then improved until last two quarters. The unit ratio had a similar but lower path than the euros. The ABP-to-ASP ratio has been above 1.0 for the last two years.

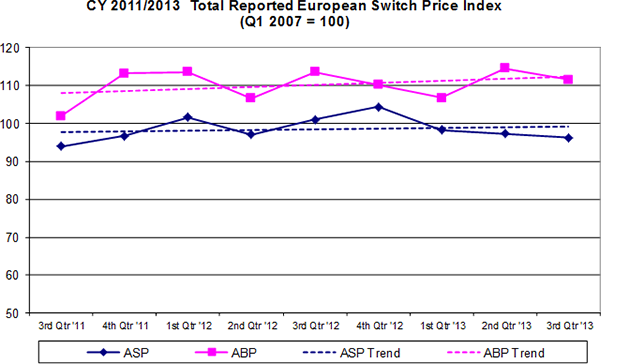

For the period, indexed sales and booking prices generally trended higher but may now be heading lower.