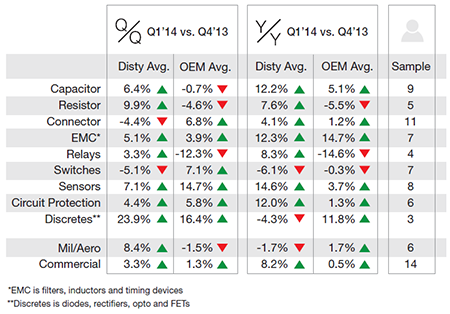

In May, an informal survey was conducted of TTI’s suppliers. We asked them about their Q1 2014 growth rates in North America by product type – comparing the prior quarter and the same quarter of the prior year. These suppliers provided data for both distribution Point Of Sale (POS) and direct Original Equipment Manufacturer (OEM) business. We also asked for this data for military/aerospace and commercial business. The data is summarized in the table below.

Results: The trend for both distributor POS and OEM sales in Q1’14 were stronger both quarter-over-quarter (Q/Q) and year-over-year (Y/Y) with the greatest growth occurring relative to Q1’13. Beneath the general trend, however, there are inconsistencies between product types, and the results through the channel versus OEM sales. Q1’14 passive sales (capacitors, resistors and EMC) through distribution were strongly positive both Q/Q and Y/Y with OEM sales significantly underperforming compared to the channel.

Interconnects and switches the saw the opposite with OEM sales leading distribution. In fact, Q/Q distributor sales were down for both and switch sales were down Y/Y.

Relays, sensors, circuit protection devices and discrete semiconductors all experienced growth Q/Q and, with the exception of discretes, all experienced Y/Y growth as well. OEM results were the same for sensors, circuit protection devices and discretes while OEM sales in the relay category were down significantly both Q/Q and Y/Y.

Except for good Q/Q growth in distribution sales to military and aerospace customers, primarily due to good activity in commercial aerospace, the mil/aero sector, which predominately uses mil-spec components, is on a downward trend relative to commercial customers.

The results of this survey are not surprising. In the first quarter of this year, TTI experienced solid growth in all market and product segments, healthy book-to-bill ratios, and saw lead times in many products start to slowly inch out – a trend that has continued into the second quarter.

While the individual supplier results had wide ranges by product type, in aggregate, the survey indicates that the component manufacturers seem to be having a better year in North America.